Concept explainers

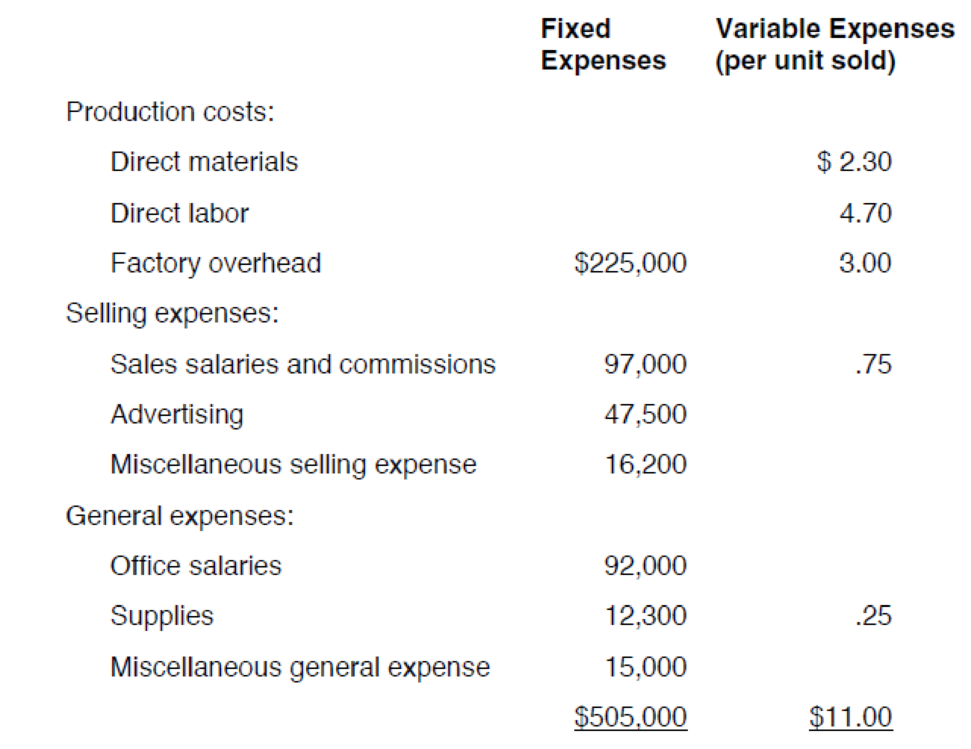

Poleski Manufacturing, which maintains the same level of inventory at the end of each year, provided the following information about expenses anticipated for next year:

The selling price of Poleskiʼs single product is $16. In recent years, profits have fallen and Poleskiʼs management is now considering a number of alternatives. Poleski wants to have a net income next year of $250,000, but expects to sell only 120,000 units unless some changes are made.

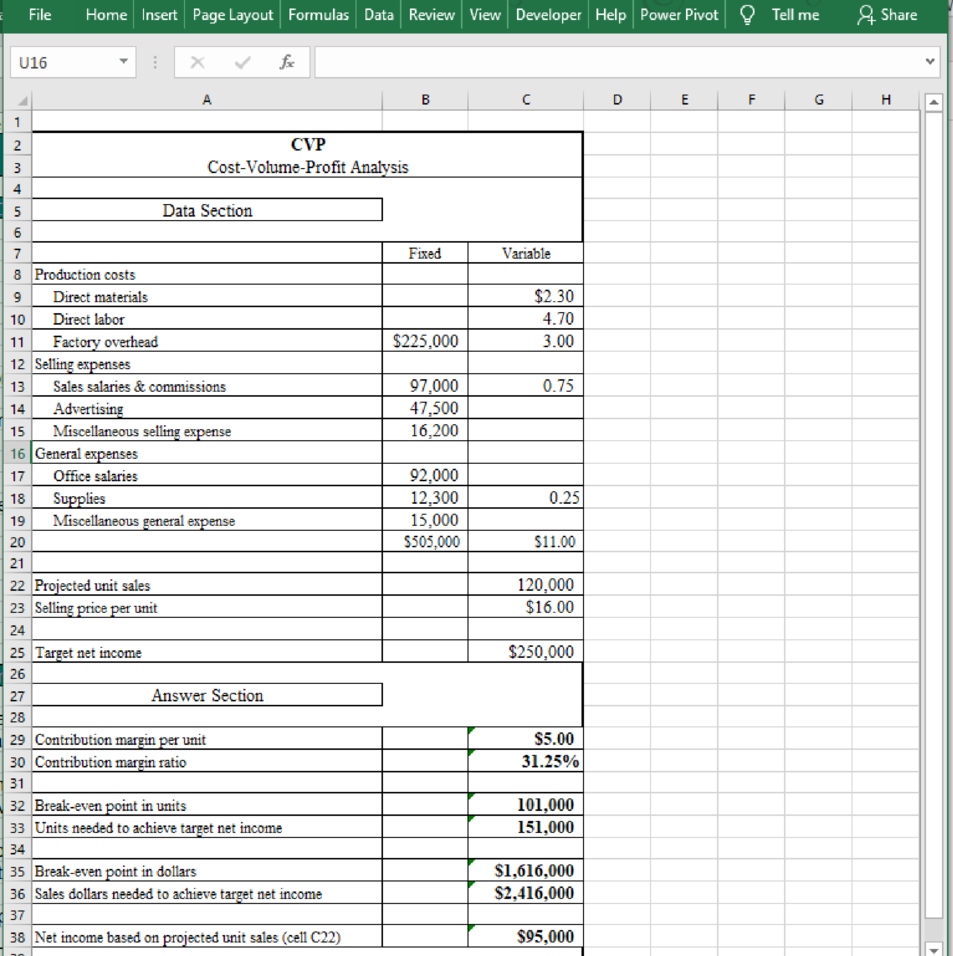

The president of Poleski has asked you to calculate the companyʼs projected net income (assuming 120,000 units are sold) and the sales needed to achieve the companyʼs net income objective for next year. Also, compute Poleskiʼs contribution margin per unit, contribution margin ratio, and break-even point for next year. The worksheet CVP has been provided to assist you. Note that the data from the problem have already been entered into the Data Section of the worksheet.

Compute the projected net income of the company and the sales required to attain the net income objective for next year. Calculate contribution margin per unit, contribution margin ratio, and break-even point for next year.

Explanation of Solution

The projected net income, sales required to attain the net income, contribution margin per unit, contribution margin ratio, and break-even pointfor next year are calculated as follows:

Table (1)

Want to see more full solutions like this?

Chapter 18 Solutions

Excel Applications for Accounting Principles

- One Manila Inc.'s president, Zane Cruz, is concerned about the prospects of one of the firm's major products. The president has been reviewing a marketing report with Jom Lara, marketing product manager, for their top-of-the-line stereo amplifier. The report indicates another price reduction is needed to meet anticipated competitors' reduction in sales prices. The current selling price for OMI's amplifier is P35,000 per unit. It is expected that within three months OMI's two major competitors will be selling their comparable amplifiers for P30,000 per unit. This concerns CRUZ because OMI's current cost of producing the amplifiers is P31,500, which yields a P3,500 profit on each unit sold. The situation is especially disturbing because OMI had implemented an activity-based costing (ABC) system about two years ago. The ABC system helped them better identify costs, cost pools, cost drivers, and cost reduction opportunities. Changes made when adopting ABC reduced costs on this…arrow_forwardThe vice-president of sales and marketing, Madison Tremblay, is trying to plan for the coming year in terms of production needs to meet the forecast sales. The board of directors is very supportive of any initiatives that will lead to increased operating income for the company in the upcoming year. Waterways markets a simple water controller and timer that it mass-produces. During 2022. the company sold 322.500 units at an average selling price of $8.00 per unit. The variable costs were $1,193,250. and the fixed costs were $606,300. What is the margin of safety, both in dollars and as a ratio? (Round ratio to 2 decimal places, e.g. 25.25%) $ Margin of safety in dollars Margin of safety ratioarrow_forwardA company intends to install new management software for its warehouse. The software will cost $47,000 to buy and will cost an additional $148,000 to install and implement. It is anticipated that it will save the company $44,000 through reductions in staff and $69,000 in general inventory costs in the first year after installation. What is the total benefit to the company in the first year if they choose to install the software?arrow_forward

- A firm manufactures and sells high quality business printers and ink toners. Each printer sells for $650 and each toner for $100. The average user keeps the printer for 5 years and consumes 4 toners every year. In response to a recent significant drop in printer sales (which will reduce future toner sales as well) the firm wants to lower the printer price to $500. Assume that income from toner sales occurs at year-end and the firm’s cost of capital is 10%. How much of an increase is needed in the toner price to cover the loss in printer price?arrow_forwardGarrett Industries turns over its inventory six times each year; it has an average collection period of 35 days and an average payment period of 30 days. The firm’s annual sales are $ 5 million, costs of goods sold $ 1 million while other operating costs excluding depreciation $ 2 million. Based on the data find the firm’s cash conversion cycle and resource investment requirement if it makes the following changes simultaneously: (1) Shortens the average age of inventory by 5 days. (2) Speeds the collection of accounts receivable by an average of 10 days. (3) Extends the average payment period by 10 days. If the firm pays 13% WACC, by how much, if anything, could it reduce annual costs of working capital financing?arrow_forwardGood-Deal Inc. developed a new sales gimmick to help sell its inventory of new automobiles. Because many new car buyers need financing, Good-Deal offered a low downpayment and low car payments for the first year after purchase. It believes that this promotion will bring in some new buyers. On January 1, 2020, a customer purchased a new $33,000 automobile, making a downpayment of $1,000. The customer signed a note indicating that the annual rate of interest would be 8% and that quarterly payments would be made over 3 years. For the first year, Good-Deal required a $400 quarterly payment to be made on April 1, July 1, October 1, and January 1, 2021. After this one-year period, the customer was required to make regular quarterly payments that would pay off the loan as of January 1, 2023. Instructions a. Prepare a note amortization schedule for the first year. b. Indicate the amount the customer owes on the contract at the end of the first year. c. Compute the amount of the new…arrow_forward

- [The following information applies to the questions displayed below.] Black Diamond Company produces snow skis. Each ski requires 2 pounds of carbon fiber. The company's management predicts that 5,000 skis and 6,000 pounds of carbon fiber will be in inventory on June 30 of the current year and that 150,000 skis will be sold during the next (third) quarter. A set of two skis sells for $300. Management wants to end the third quarter with 3,500 skis and 4,000 pounds of carbon fiber in inventory. Carbon fiber can be purchased for $15 per pound. Each ski requires 0.5 hours of direct labor at $20 per hour. Variable overhead is applied at the rate of $8 per direct labor hour. The company budgets fixed overhead of $1,782,000 for the quarter. 3. Prepare the direct labor budget for the third quarter. BLACK DIAMOND COMPANY Direct Labor Budget Third Quarter Units to be produced Total labor hours needed Budgeted direct labor costarrow_forwardMr. Ador Estoria, the operations manager of Achos Merchandising Corp. Is worried about the result of its operation this year. Although the accounting dept. has not submitted the financial statements yet, the following data where already available pertaining to year 2020. Total number of units sold at P50 per unit price 120,000 units Total fixed costs and expenses P1,800,000 Variable cost rate 60% Because of other pressing problems, he hired you to give him information and computation that will help him plan for the next year operation. He specifically wants the following (with proofs, if possible): If management projects a profit of P1,200,000 after the 25% tax, how many units should be sold? If the total peso sales generated next year is short by P1million in order to break-even, what is the result of the operation? If the selling price…arrow_forwardMr. Ador Estoria, the operations manager of Achos Merchandising Corp. Is worried about the result of its operation this year. Although the accounting dept. has not submitted the financial statements yet, the following data where already available pertaining to year 2020. Total number of units sold at P50 per unit price 120,000 units Total fixed costs and expenses P1,800,000 Variable cost rate 60% Because of other pressing problems, he hired you to give him information and computation that will help him plan for the next year operation. He specifically wants the following (with proofs, if possible): Break-even point in peso sales and in units The margin of safety in peso, in units and in percentage If the profit this year will be doubled next year, how much sales should be realized? If the number of units sold next year, exceeds the…arrow_forward

- Larson, Inc., manufactures backpacks. Last year, it sold 87,500 of its basic model for $15 per unit. The company estimates that this volume represents a 25 percent share of the current market. The market is expected to increase by 15 percent next year. Marketing specialists have determined that as a result of new competition, the company's market share will fall to 20 percent (of this larger market). Due to changes in prices, the new price for the backpacks will be $12 per unit. This new price is expected to be in line with the competition and have no effect on the volume estimates. Required: Estimate Larson's sales revenues from this model of backpack for the coming year. Sales revenuearrow_forwardMr. Josh Kho, the operations manager of Achos Merchandising Corp. Is worried about the result of its operation this year. Although the accounting dept. has not submitted the financial statements yet, the following data where already available pertaining to year 2020. Total number of units sold at P50 per unit price 120,000 units Total fixed costs and expenses P1,600,000 Variable cost rate 60% Because of other pressing problems, he hired you to give him information and computation that will help him plan for the next year operation. He specifically wants the following (with proofs, if possible): If management wants 15% profit from sales, how many units should the company sells? What is the degree of operating leverage (DOL)? If management projects that sales will reduce by 10% next year, what is the percentage decrease in profit? If the selling price per unit next year is reduced by 10% and an increase in variable cost per unit by 5% due to the…arrow_forwardMr. Josh Kho, the operations manager of Achos Merchandising Corp. Is worried about the result of its operation this year. Although the accounting dept. has not submitted the financial statements yet, the following data where already available pertaining to year 2020. Total number of units sold at P50 per unit price 120,000 units Total fixed costs and expenses P1,600,000 Variable cost rate 60% Because of other pressing problems, he hired you to give him information and computation that will help him plan for the next year operation. He specifically wants the following (with proofs, if possible): Break-even point in peso sales and in units The margin of safety in peso, in units and in percentage If the profit this year will be doubled next year, how much sales should be realized? If the number of units sold next year, exceeds the break-even point by 50,000 units, what is result of the operation? If management projects a profit of P1,200,000 after the…arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT