Fundamentals of Financial Accounting

5th Edition

ISBN: 9780078025914

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.1CP

Determining Financial Statement Effects of Various Transactions

Ag Bio Tech (ABT) was organized on January 1 by four friends. Each organizer invested $10,000 in the company and, in turn, was issued 8,000 shares of common stock. To date, they are the only stockholders. During the first month (January), the company had the following Five events:

- a. Collected a total of $40,000 from the organizers and. in turn, issued common stock.

- b. Purchased a building for $65,000, equipment for $16,000, and three acres of land for $18.000; paid $13,000 in cash and signed a note for the balance, which is due to be paid in 15 years.

- c. One stockholder reported to the company that 500 shares of his ABT stock had been sold and transferred to another stockholder for $5,000 cash.

- d. Purchased supplies for $3,000 cash.

- e. Sold one acre of land for $6,000 cash to another company.

Required:

- 1. Was ABT organized as a

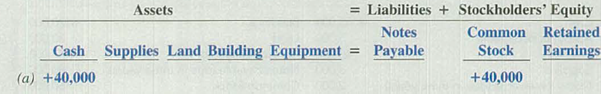

partnership or corporation? Explain the basis for your answer. - 2. During the first month, the records of the company were inadequate. You were asked to prepare a summary of the preceding transactions. To develop a quick assessment of their economic effects on ABT, you have decided to complete the spreadsheet that follows and to use plus (+) for increases and minus (−) for decreases for each account.

TIP: Transaction (a) is presented below as an example.

- 3. Did you include the transaction between the two stockholders—event (c)—in the spreadsheet? Why?

TIP: Think about whether this event caused ABT to receive or give up anything.

- 4. Based only on the completed spreadsheet, provide the following amounts (show computations):

- a. Total assets at the end of the month.

- b. Total liabilities at the end of the month.

- c. Total stockholders’ equity at the end of the month.

- d. Cash balance at the end of the month.

- e. Total current assets at the end of the month.

- 5. As of January 31, has the financing for ABT’s investment in assets primarily come from liabilities or stockholders’ equity?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following selected transactions occurred for Corner Corporation:Feb. 1 Purchased 400 shares of the company’s own common stock at $20 cash per share;the stock is now held in treasury.July 15 Issued 100 of the shares purchased on February 1 for $30 cash per share.Sept. 1 Issued 60 more of the shares purchased on February 1 for $15 cash per share.Required:1. Show the effects of each transaction on the accounting equation.2. Give the indicated journal entries for each of the transactions.3. What impact does the purchase of treasury stock have on dividends paid?4. What impact does the reissuance of treasury stock for an amount higher than the purchaseprice have on net income?

During the year the following selected transactions affecting stockholders' equity occurred for

Orlando Corporation:

a. April 1: Repurchased 240 shares of the company's common stock at $30 cash per share.

b. June 14: Sold 60 of the shares purchased on April 1 for $35 cash per share.

c. September 1: Sold 50 of the shares purchased on April 1 for $25 cash per share.

Required:

1. Prepare journal entries for each of the above transactions.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the

first account field.

View transaction list

Journal entry worksheet

1

2

3

Repurchased 240 shares of the company's common stock at $30 cash per

share.

Note: Enter debits before credits.

Date

April 01

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

Prepare journal entries to record the following selected transactions.

January 10 Issued 121,000 shares of $2 par value common stock for $7 cash per share..

January 15 Issued 11,900 shares of $2 par value common stock in exchange for equipment with a market value of $89,000.

February 1 Issued 600 shares of $2 par value common stock to its promoters in exchange for their efforts, estimated to

be worth $4,900.

View transaction list

Journal entry worksheet

<

A

в с

Issued 121,000 shares of $2 par value common stock for $7 cash per share.

Note: Enter debits before credits.

Date

January 10

General Journal

Debit

Credit

Chapter 2 Solutions

Fundamentals of Financial Accounting

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 2.1MECh. 2 - Prob. 2.2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 2.4MECh. 2 - Prob. 2.5MECh. 2 - Prob. 2.6MECh. 2 - Prob. 2.7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 2.13MECh. 2 - Prob. 2.14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 2.16MECh. 2 - Prob. 2.17MECh. 2 - Prob. 2.18MECh. 2 - Prob. 2.19MECh. 2 - Prob. 2.20MECh. 2 - Prob. 2.21MECh. 2 - Prob. 2.22MECh. 2 - Prob. 2.23MECh. 2 - Prob. 2.24MECh. 2 - Prob. 2.25MECh. 2 - Prob. 2.1ECh. 2 - Prob. 2.2ECh. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Prob. 2.5ECh. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 2.7ECh. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2.2PBCh. 2 - Prob. 2.3PBCh. 2 - Prob. 2.1SDCCh. 2 - Prob. 2.2SDCCh. 2 - Prob. 2.4SDCCh. 2 - Prob. 2.5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $1 parvalue. During its first year, the following selected transactions were completed:a. Issued 6,000 shares of common stock for cash at $20 per share.b. Issued 2,000 shares of common stock for cash at $23 per share.Required:1. Show the effects of each transaction on the accounting equation.2. Give the journal entry required for each of these transactions.3. Prepare the stockholders’ equity section as it should be reported on the year-end balancesheet. At year-end, the accounts reflected a profit of $100.4. Incentive Corporation has $30,000 in the company’s bank account. What is the maximumamount of cash dividends the company can declare and distribute?arrow_forwardDuring the year the following selected transactions affecting stockholders' equity occurred for Orlando Corporation: a. April 1: Repurchased 390 shares of the company's common stock at $38 cash per share. b. June 14: Sold 70 of the shares purchased on April 1 for $43 cash per share. c. September 1: Sold 60 of the shares purchased on April 1 for $33 cash per share. Required: 1. Prepare journal entries for each of the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Answer is not complete. No 1 Date April 01 General Journal Debit Credit Treasury stock 14,820 Cash 14,820 2 June 14 Cash Treasury stock Additional paid-in capital 3,010 2,660 350 3 September 01 Cash 1,980 Additional paid-in capital Treasury stock 300X 1,680 xarrow_forwardDuring the year, the following selected transactions affecting stockholders' equity occurred for Navajo Corporation: a. February 1: Repurchased 240 shares of the company's common stock at $22 cash per share. b. July 15: Sold 130 of the shares purchased on February 1 for $23 cash per share. c. September 1: Sold 100 of the shares purchased on February 1 for $21 cash per share. Required: 1. Prepare the journal entry required for each of the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 Repurchased 240 shares of the company's common stock at $22 cash per share. Date February 01 3 Note: Enter debits before credits. Record entry General Journal Clear entry Prev Debit 1 of 8 Credit View general journal ‒‒‒ ‒‒‒ ‒‒‒ Next > *********arrow_forward

- Ergonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 75,000 shares of 2% preferred stock, $75 par and 450,000 shares of $15 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. July 1. Issued 75,000 shares of common stock at par for cash. If an amount box does not require an entry, leave it blank. July 1 Cash Common Stock July 1 Issued 450 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. If an amount box does not require an entry, leave it blank. July 1 Aug. 7. Issued 23,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $63,000, $343,000, and $77,000, respectively. If an amount box does not require an entry, leave it blank. Aug. 7 Sept. 20. Issued 23,000 shares of preferred stock at $84 for cash. If an amount box does not require…arrow_forwardBeauty Island Corporation began operations in April by completing these transactions: Apr01... issued 60,000 shares of $5 par value common stock for cash at $13 per share. Apr19... issued 2,000 shares of common stock to attorneys in "payment" of their bill of $27,500 for organization costs. Apr20... issued 1,000 shares of $1 par value preferred stock for $6 cash per share. Journalize the issuing of common & preferred shares, (assuming shares are not publicly traded). Apr 01 Apr 19 Apr 20 The separation of paid-in capital from earned capital concerns the issue of “legal capital". "Legal" capital limits dividends to within total of retained earnings and any additional paid-in capital. "Capital" is categorized as "Paid-in" and "Earned". Paid-in capital (also called contributed capital) is provided by investors when they buy a company's initially issued shares. Earned capital is retained earnings, the accumulated income a company has earned since its inception. These distinctions only…arrow_forwardThe following selected transactions occurred for Corner Corporation: Feb. 1 Purchased 420 shares of the company’s own common stock at $22 cash per share; the stock is now held in treasury. July 15 Issued 110 of the shares purchased on February 1 for $32 cash per share. Sept. 1 Issued 70 more of the shares purchased on February 1 for $17 cash per share. Required: Indicate the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with a minus sign.) Prepare journal entries for each of the transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) What impact does the purchase of treasury stock have on dividends paid?arrow_forward

- During its first year of operations, Larkspur, Inc. had the following transactions pertaining to its common stock. Jan. 10 Issued 75,000 shares for cash at $6 per share. July 1 Issued 41,000 shares for cash at $9 per share. A.) Journalize the transactions, assuming that the common stock has a par value of $6 per share. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit B.) Journalize the transactions, assuming that the common stock is no-par with a stated value of $1 per…arrow_forwarda. Journalize the following transactions: i. January 10. Received cash from three incorporators for 75,000 shares of common stock, $375,000.00. R1-3. ii. iii. iv. V. vi. vii. viii. ix. January 10. Paid cash to Aaron Lovell as a reimbursement for organization costs, $10,000. C1. Value of Preferred Stock January 10. Received a subscription from Amory Lin for 10,000 shares of common stock, $50,000.00. M1. Total Amount of Dividends January 15. Received cash for the face value of a 5-year, 10%, $1,000.00 par value bond issue, $50,000.00. R11. January 25. Received a subscription from Peter Lavine for 8,000 shares of common stock, $40,000.00. M2. February 14. Received cash from Amory Lin in partial payment of stock subscription, $25,000. R4. March 15. Paid cash to Peter Lavine for 500 shares of common stock at $10.00 per share. C112. March 20. Received cash from Amory Lin in final payment of stock subscription, $25,000.00. R5. b. At the end of the year, Al-Can Products, Inc. had issued…arrow_forwardTarrant Corporation was organized this year to operate a financial consulting business. The charter authorized the following stock: common stock, par value $17 per share, 13,400 shares authorized. During e year, the following selected transactions were completed: Sold and Issued 6,800 shares of common stock for cash at $34 per share. b. Sold and Issued 1700 shares of common stock for cash at $39 per share 12. Required information Required: 1. Prepare the journal entries required to record the sale of common stock in (a) and (b). (If no entry ls required for a transaction/event, select "No Journal entry required In the first account field.) view transaction list view general journal Journal Entry Worksheet 0 2 sold 6,800 shares of common stock for cash at $34 per share Debit Credit Transaction General Joumaarrow_forward

- During its first year of operations, Wildhorse Corporation had the following transactions pertaining to its common stock. Jan. 10 Issued 60,000 shares for cash at $7 per share. July 1 Issued 50,000 shares for cash at $10 per share. (a) Journalize the transactions, assuming that the common stock has a par value of $7 per share. (Record journal entries in the order presented in enter o for the amounts.) Date Account Titles and Explanation Debit Creditarrow_forwardPrepare a General Journal, a General Ledger and an unadjusted trial balance for the following: The articles of incorporation for Bella Computers specified that the corporation was authorized to issue 1 million shares of common stock; par value was set at $10 per share. During the meeting, stock certificates for 5,000 shares of $10.00 par stock were issued to Dale and Lee, each. Dale and Lee each wrote personal checks for $50,000 for deposit in the new business bank account. As officers of the new Bella Computers Company, Dale and Lee, were both required to sign all company expense checks. As soon as the meeting ended Dale and Lee drove to the warehouse facilities that they had arranged to lease for one year. The lease would be a 1-year prepaid lease for the sum of $1,000 per month. The company wrote a check that day to the real estate company for the entire sum for the first year’s lease. Also on June 1, Bella Computers paid deposits to the Electric Company for initial service hook-up.…arrow_forwardSep. 6 Issued 500 shares of common stock to the promoters who organized the corporation, receiving cash of $15,000. Sep. 12 Issued 700 shares of preferred stock for cash of $29,000. Sep. 14 Issued 1,400 shares of common stock in exchange for land with a market value of $23,000. Assume KVIP−TV, Inc. had net income of $31,000 for the month. Requirement 1. Record the transactions in the general journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Sep. 6: Issued 500 shares of common stock to the promoters who organized the corporation, receiving cash of $15,000. Date Accounts and Explanation Debit Credit Sep. 6 Part 2 Sep. 12: Issued 700 shares of preferred stock for cash of $29,000. Date Accounts and Explanation Debit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY