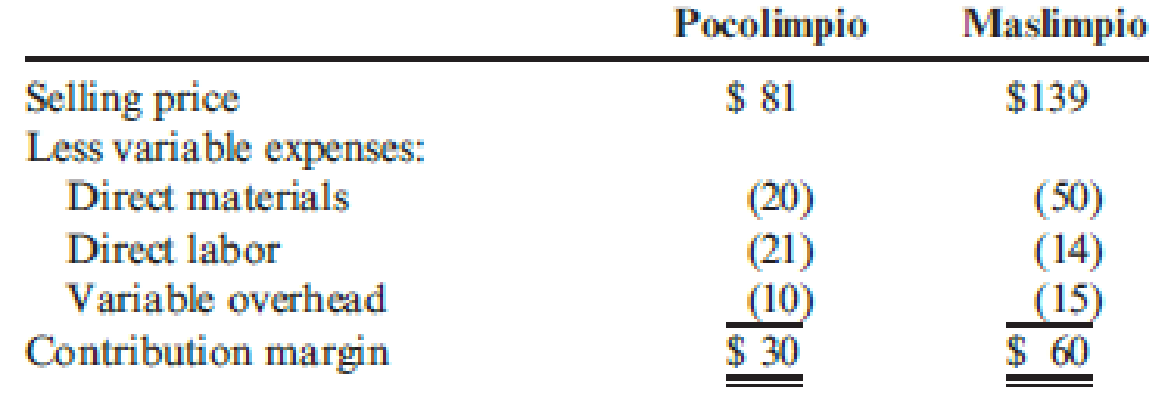

Taylor Company produces two industrial cleansers that use the same liquid chemical input: Pocolimpio and Maslimpio. Pocolimpio uses two quarts of the chemical for every unit produced, and Maslimpio uses five quarts. Currently, Taylor has 6,000 quarts of the material in inventory. All of the material is imported. For the coming year, Taylor plans to import 6,000 quarts to produce 1,000 units of Pocolimpio and 2,000 units of Maslimpio. The detail of each product’s unit contribution margin is as follows:

Taylor Company has received word that the source of the material has been shut down by embargo. Consequently, the company will not be able to import the 6,000 quarts it planned to use in the coming year’s production. There is no other source of the material.

Required:

- 1. Compute the total contribution margin that the company would earn if it could import the 6,000 quarts of the material.

- 2. Determine the optimal usage of the company’s inventory of 6,000 quarts of the material. Compute the total contribution margin for the product mix that you recommend.

- 3. Assume that Pocolimpio uses three direct labor hours for every unit produced and that Maslimpio uses two hours. A total of 6,000 direct labor hours is available for the coming year.

- a. Formulate the linear programming problem faced by Taylor Company. To do so, you must derive mathematical expressions for the objective function and for the materials and labor constraints.

- b. Solve the linear programming problem using the graphical approach.

- c. Compute the total contribution margin produced by the optimal mix.

Trending nowThis is a popular solution!

Chapter 20 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Caribu Company produces sanitation products after processing specialized chemicals; The following relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, a gram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Caribu can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. Required: Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV methodarrow_forwardZanda Drug Corporation buys three chemicals that are processed to produce two types of analgesics used as ingredients for popular over-the-counter drugs. The purchased chemicals are blended for two to three hours and then heated for 15 minutes. The results of the process are two separate analgesics, depryl and pencol, which are sent to a drying room until their moisture content is reduced to 6 to 8 per cent. For every 1300 kilograms of chemicals used, 600 kilograms of depryl and 600 kilograms of pencol are produced. After drying. depryl and pencol are sold to companies that process them into their final form. The selling prices are $12 per kilogram for depryl and $30 per kilogram for pencol. The costs to produce 600 kilograms of each analgesic are as follows: Chemicals Direct labour Overhead The analgesics are packaged in 20-kilogram bags and shipped. The cost of each bag is $1.30. Shipping costs $0.10 per kilogram. $8 500 6 735 9 900 Zanda could process depryl further by grinding it…arrow_forwardJohnson Corp. has two divisions, Division A and Division B. Division B has asked Division A to supply it with 5,000 units of part WD26 this year to use in one of its products. Division A has the capacity to produce 25,000 units of part WD26 per year. Division A expects to sell 21,000 units of part WD26 to outside customers this year at a price of $20.00 per unit. To fill the order from Division B, Division A would have to cut back its sales to outside customers. Division A's variable manufacturing cost (direct labor + direct material + variable overhead) for part WD26 is $12.00 per unit. The variable selling cost when selling to outside customers is $2.00 per unit. This variable selling cost would not have to be incurred on sales of the parts to Division B. Q. Calculate Division A's minimum acceptable transfer price. A. $arrow_forward

- GETSNYA manufactures two industrial products in a joint process. In January, 10,000 gallons of input costing P120,000 were processed at a cost of P300,000. The joint process resulted in 8,000 pounds of Product One and 2,000 pounds of Product Two. Product One sells at P50 per pound and Product Two sells for P100 per pound. Management generally processes each of these chemicals further to produce more refined chemical products. Product One is processed separately at a cost of P10 per pound, the resulting product sells for P70 per pound. Product Two is processed separately at a cost of P30 per pound, the resulting product sells for P190 per pound.Assuming that management is considering an opportunity to process Product Two into a new product. The separable processing will cost P80 per pound. Packaging costs for the new product is projected to be P12 per pound, and anticipated sales price is P260 per pound. Should Product Two be processed further into a new product? a. Yes, because…arrow_forwardCarina Company produces sanitation products after processing specialized chemicals; The following relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. Required:1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardBetram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $74,000, and the result is 6,000 gallons of anderine and 8,000 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $11 per gallon and the dofinol for $6.75 per gallon. Alternatively, the anderine can be processed further at a cost of $8 per gallon (of anderine) into cermine. It takes 3 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $60. Required: 1. Which alternative is more cost effective and by how much? Process it further by $fill in the blank 2 2. What if the production of anderine into cermine required additional purchasing and quality inspection activity? Every 500 gallons of anderine that undergo further processing require 20 more purchase orders at $10 each and 15 more quality inspection hours at…arrow_forward

- The Casings Plant of Wyoming Machines makes plastics shells for the company’s calculators. (Each calculator requires one shell.) For each of the next two years, Wyoming expects to sell 650,000 calculators. The beginning finished goods inventory of shells at the Casings Plant is 100,000 units. However, the target ending finished goods inventory for each year is 20,000 units. Each unit (shell) requires 6 ounces of plastic. At the beginning of the year, 200,000 ounces of plastic are in inventory. Management has set a target to have plastic on hand equal to four months’ sales requirements. Sales and production take place evenly throughout the year. Required: a. Compute the total targeted production of the finished product for the coming year. b. Compute the required amount of plastic to be purchased for the coming year. (Do not round intermediate calculations.)arrow_forwardCaribu Company produces sanitation products after processing specialized chemicals; The following relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Caribu can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method ] 2. Should Caribu have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardThe Casings Plant of Wyoming Machines makes plastics shells for the company's calculators. (Each calculator requires one shell.) For each of the next two years, Wyoming expects to sell 660,000 calculators. The beginning finished goods inventory of shells at the Casings Plant is 90,000 units. However, the target ending finished goods inventory for each year is 15,000 units. Each unit (shelI) requires 6 ounces of plastic. At the beginning of the year, 250,000 ounces of plastic are in inventory. Management has set a target to have plastic on hand equal to two months' sales requirements. Sales and production take place evenly throughout the year. Required: a. Compute the total targeted production of the finished product for the coming year. b. Compute the required amount of plastic to be purchased for the coming year. (Do not round intermediate calculations.) Total targeted production in units 585,000 а. b. Materials to be purchased in ouncesarrow_forward

- ABC Chemical Company manufactures industrial chemicals. The company plans to introduce a new chemical solution and needs to develop a standard product cost. The new chemical solution is made by combining a chemical compound (nyclyn) with a solution (salex), heating the mixture to boiling point, adding a second compound (protet), and bottling the resulting solution in 15-litre containers. The initial mix, which is 12 litres in volume, consists of 14 kilograms of nyclyn and 11.6 litres of salex. A 1-litre reduction in volume occurs during the boiling process. The solution is cooled slightly before 8 kilograms of protet are added. The protet evaporates, so it does not affect the total liquid volume. The purchase prices of the raw materials used in the manufacture of this new chemical solution are as follows: Nyclyn $4.90 per kilogram Salex $5.60 per litre Protet $6.80 per kilogram a. 102.36 b. None of the answers given c. 98.36 d. 93.36arrow_forwardShalom Company manufactures and sells Peace products. During the year, the company estimated for the production and sale of 15,000 units of Peace products. Each unit requires 1.50 kilos of direct material at a cost of P8 per pound. It takes 15 minutes to manufacture each unit of Peace product at a cost of P0.18 per minute. At the end of the current year, Shalom had produced and sold 16,000 Peace products for P50 per unit. The actual costs for direct materials and direct labor were P179,200, and P44,800, respectively. In your flexible budget performance report, identify the difference between budgeted and actual costs and indicate as favorable or unfavorable. Format should be: 8,000 F or 8,000 UF No need to indicate if the amount is positive or negative. direct materialsarrow_forwardBetram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $73,000, and the result is 5,900 gallons of anderine and 8,200 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $12.00 per gallon and the dofinol for $6.30 per gallon. Alternatively, the anderine can be processed further at a cost of $7.90 per gallon (of anderine) into cermine. It takes 4 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $65.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning