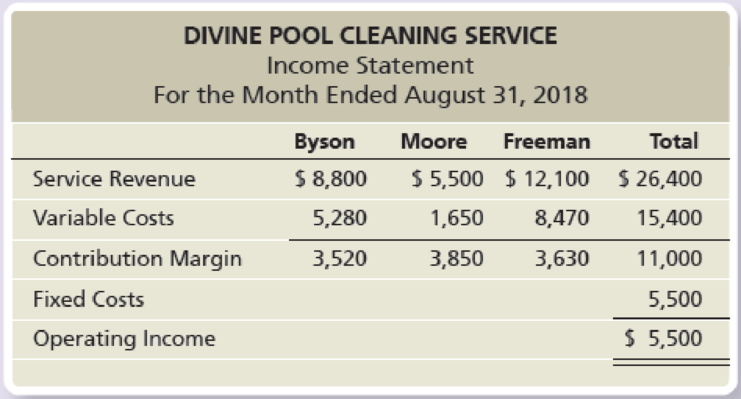

Divine Pool Cleaning Service provides pool cleaning services to residential customers. The company has three employees, each assigned to specific customers. The company considers each employee’s territory as a business segment. The company incurs variable costs that include the employees’ wages, pool chemicals, and gas for the service vans. Fixed costs include depreciation on the service vans. Following is the income statement for the month of August:

Requirements

- 1. Calculate the contribution margin ratio for each business segment.

- 2. The business segments had the following number of customers: Byson, 80; Moore, 50; and Freeman, 110. Compute the service revenue per customer, variable cost per customer, and contribution margin per customer for each business segment.

- 3. Which business segment was most profitable? List some possible reasons why this segment was most profitable. How might the various reasons affect the company in the long term?

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Financial Accounting (11th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting

Fundamentals of Financial Accounting

Managerial Accounting (5th Edition)

- King's Appliance Shop operates retail stores that sell appliances. The cost objects are the individual sales of a given type of appliance and sales support. In July, the following costs were recorded for refrigerators: Professional sales staff commissions Amortization on office space Selling supplies Office staff expenses Customer relations Training expenses Utilities $84,000 4,000 6,400 24,800 8,600 6,000 1,400 Required: a. Which of the costs will be subject to direct cost tracing? b. What is the total cost for refrigerators? c. What is the total cost of the Sales Support for refrigerators?arrow_forwardJPAK manufactures and sells mountain bikes. It operates eight hours a day, five days a week. Using this information,classify each of the following costs as fixed or variable with respect to the number of bikes made. Office suppliesarrow_forwardVentana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventanas income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year. Required: 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.) 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)arrow_forward

- A company uses charging rates to allocate service department costs to the using departments. The accountant compiled the following information on one of the service departments: If Department K plans to use 1,350 hours of the service departments service in the coming year, how much of the service departments cost is allocated to Department K? a. 3,375 b. 27,300 c. 26,325 d. 23,950arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forward

- Identifying Fixed, Variable, Mixed, and Step Costs Consider each of the following independent situations: a. A computer service agreement in which a company pays 150 per month and 15 per hour of technical time b. Fuel cost of the companys fleet of motor vehicles c. The cost of beer for a bar d. The cost of computer printers and copiers at your college e. Rent for a dental office f. The salary of a receptionist in a law firm g. The wages of counter help in a fast-food restaurant h. The salaries of dental hygienists in a three-dentist office. One hygienist can take care of 120 cleanings per month. i. Electricity cost which includes a 15 per month billing charge and an additional amount depending on the number of kilowatt-hours used Required: 1. For each situation, describe the cost as one of the following: fixed cost, variable cost, mixed cost, or step cost. (Hint: First, consider what the driver or output measure is. If additional assumptions are necessary to support your cost type decision, be sure to write them down.) Example: Raw materials used in productionVariable cost 2. CONCEPTUAL CONNECTION Change your assumption(s) for each situation so that the cost type changes to a different cost type. List the new cost type and the changed assumption(s) that gave rise to it. Example: Raw materials used in production. Changed assumptionthe materials are difficult to obtain, and a years worth must be contracted for in advance. Now, this is a fixed cost. (This is the case with diamond sales by DeBeers Inc. to its sightholders. See the following website for information: www.keyguide.net/sightholders/.)arrow_forwardThayne Company has 30 clerks that work in its Accounts Payable Department. A study revealed the following activities and the relative time demanded by each activity: Required: Classify the four activities as value-added or non-value-added, and calculate the clerical cost of each activity. For non-value-added activities, indicate why they are non-value-added.arrow_forwardWest Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forward

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardThe Grand Hotel uses activity-based costing to determine the cost of servicing customers. There are three activity pools: guest check-in, room cleaning, and meal service. The activity rates associated with each activity pool are $9 per guest check-in, $15 per room cleaning, and $5 per served meal (not including food). Nikita Johnson visited the hotel for a three-night stay. Nikita had three meals in the hotel during her visit. Determine the total activity-based cost for Nikita’s visit.arrow_forwardThe Westfield branch of Security Home Bank submitted the following cost data for last year: Teller wages Assistant branch manager salary Branch manager salary Total Virtually all other costs of the branch-rent, depreciation, utilities, and so on-are organization-sustaining costs that cannot be meaningfully assigned to individual customer transactions such as depositing checks. In addition to the cost data above, the employees of the Westfield branch were interviewed concerning how their time was distributed last year across the activities included in the activity-based costing study. The results of those interviews appear below: Teller wages Assistant branch manager salary Branch manager salary $ 144,000 74,000 90,000 $ 308,000 Activity Opening accounts Processing deposits and withdrawals Processing other customer transactions Distribution of Resource Consumption Across Activities Processing Deposits and Withdrawals 75% 15% 0% Opening Accounts 4% 15% 4% Activity Cost Pool Opening…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub