Concept explainers

Cost Flows

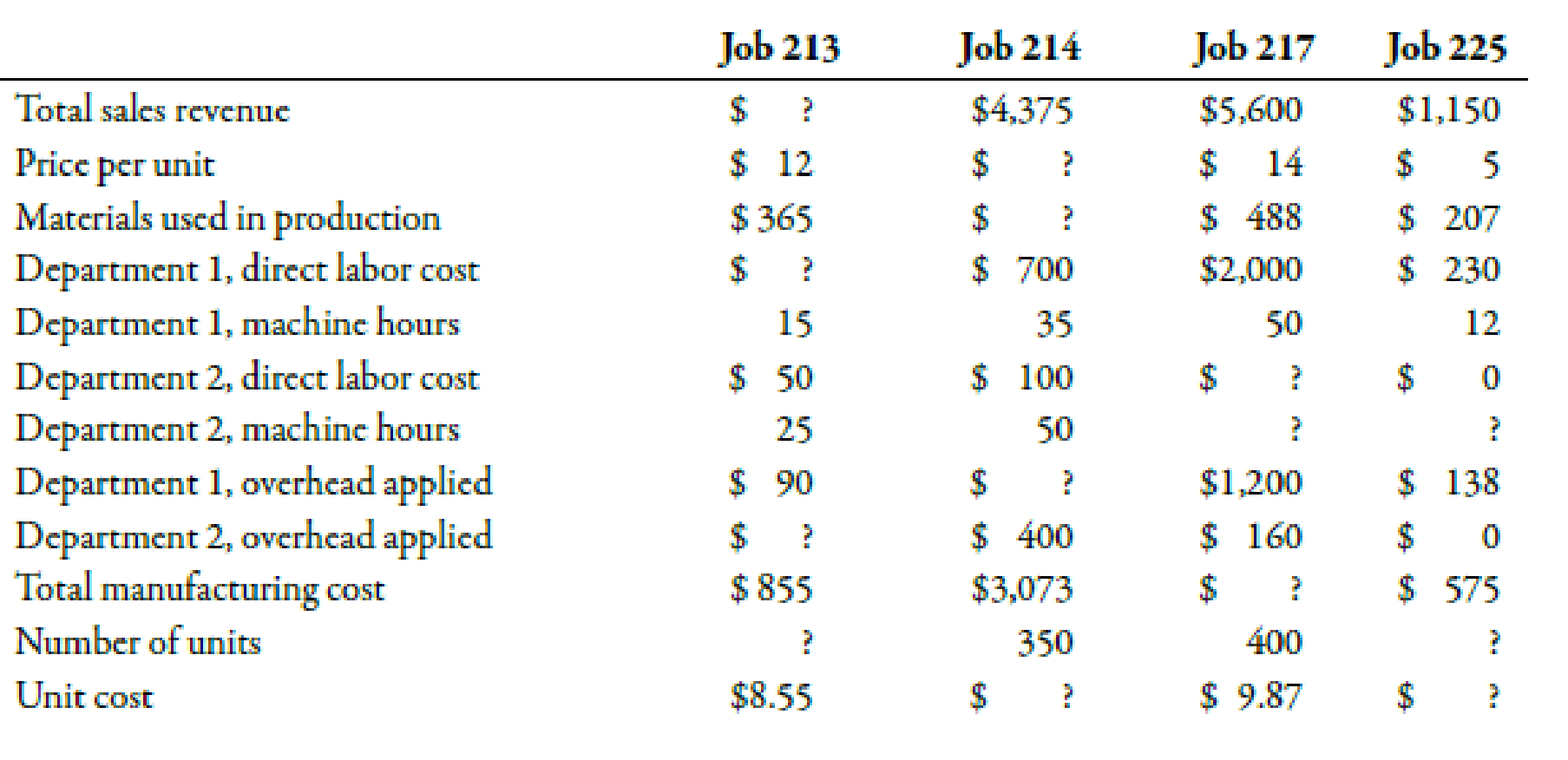

Consider the following independent jobs. Overhead is applied in Department 1 at the rate of $6 per direct labor hour. Overhead is applied in Department 2 at the rate of $8 per machine hour.

Direct labor wages average $10 per hour in each department.

Required:

Fill in the missing data for each job.

Complete the table by finding the missing amounts.

Explanation of Solution

Cost Flow:

A method which describes the way of accounting costs from the time of their occurrence to the time of their recognition as an expense on the income statement is known as cost flow.

| Job 213 | Job 214 | Job 217 | Job 225 | |

| Total sales revenue | $1,200 | $4,375 | $5,600 | $1,150 |

| Price per unit | $12 | $8.78 | $14 | $5 |

| Materials used in production | $365 | $1,453 | $488 | $207 |

| Department 1, direct labor cost | $150 | $700 | $2,000 | $230 |

| Department 1, machine hours | 15 | 35 | 50 | 12 |

| Department 2, direct labor cost | $50 | $100 | $100 | $0 |

| Department 2, machine hours | 25 | 50 | 20 | 0 |

| Department 1, overhead applied | $90 | $420 | $1,200 | $138 |

| Department 2, overhead applied | $200 | $400 | $160 | $0 |

| Total manufacturing cost | $855 | $3,073 | $3,948 | $575 |

| Number of units | 100 | 350 | 400 | 230 |

| Unit cost | $8.55 | $12.50 | $9.87 | $2.50 |

Table (1)

Working Note:

1. Job 213:

Calculation of number of units

Calculation of total sales revenue:

Calculation of department 1, direct labor hours:

Calculation of department 1, direct labor cost:

Calculation of department 2, overhead applied:

2. Job 214:

Calculation of price per unit:

Calculation of department 1, direct labor hours:

Calculation of department 1, overhead applied:

Calculation of material used:

Calculation of unit cost:

3. Job 217:

Calculation of department 2, machine hours:

Calculation of manufacturing cost:

Calculation of department 2, labor cost:

4. Job 225:

Calculation of number of units:

Calculation of unit cost:

Calculation of department 2, machine hours:

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Job order cost sheets show the following costs assigned to each job: The company assigns overhead at twice the direct labor cost. What is the total cost for each job?arrow_forwardJob order cost sheets show the following costs assigned to each job: The company assigns overhead at $1.25 for each direct labor dollar spent. What is the total cost for each of the jobs?arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forward

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardExotic Engine Shop uses a job order cost system to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: The average shop direct labor rate is 37.50 per hour. Determine the predetermined shop overhead rate per direct labor hour.arrow_forwardMarpole Enterprises has identified three cost pools to allocate overhead costs. The following estimates are provided for the coming year: (Click the icon to view the estimates of the cost pools.) The accounting records show the Bossman job consumed the following resourd ources: (Click the icon to view the resources consumed for the Bossman job.) When selling prices are based on costs assigned using the single cost driver, direct labour hours, then the Bossman job OA. may increase overall sales as other jobs will be cross-subsidized B. will contribute too little to profits, and Gregory Enterprises will not want to accept additional work from the company C. is fairly billed because resources are allocated uniformly to all jobs D. will likely seek to do business with competitors E. is grossly underbilled for the job, while other jobs will be unfairly overbilled Resources Consumed Cost Driver Direct labour-hours Machine-hours Square metres of area Actual Level 150 1,700 80 - X Estimates of…arrow_forward

- You Answered Correct Answers Harmony Inc. uses a job-costing system with two direct cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. Harmony allocates manufacturing overhead costs using direct labor costs. Harmony provides the following information: Overhead is allocated at $3/direct labor dollar. Question: How much overhead is allocated to jobs during 20X1? Budget for 20X1 Direct Materials Cost Direct Mfng Labor Cost Mfng Overhead Cost $3,120,000 2,900,000 $1,500,000 $4,500,000 Direct Mfng Labor Hours 40,000 4,350,000 (with margin: 0) Actual Results for 20X1 $1,900,000 $1,450,000 $3,355,000 50,000arrow_forwardAssume the St. Cloud plant uses a single plantwide overhead rate to assign all overhead (plantwide and department) costs to jobs. Use expected total direct labor hours to compute the overhead rate. (Round your answer to 2 decimal places.) - overhead rate per direct labor hour? What is the expected cost per unit produced for job no. 110? (Round your intermediate calculations and final answer to 2 decimal places.) - manufactoring costs for Job 110 per unit? image attachedarrow_forwardHH Electric reports the following information. Direct labor rate Non-materials-related overhead Materials-related overhead Target profit margin (on both conversion and direct materials) a. Compute the time charge per hour of direct labor. b. Compute the materials markup percentage. c. What price should the company quote for a job requiring four direct labor hours and $600 in materials? a. Time charge per hour of direct labor b. Materials markup c. Time and materials price $ 45 per DLH $ 25 per DLH 5% of direct materials cost 20% %arrow_forward

- 1. Determine departmental overhead rates and compute the overhead cost per unit for each product line. Base your overhead assignment for the components department on machine hours. Use welding hours to assign overhead costs to the finishing department. Assign costs to the support department based on number of purchase orders.2. Determine the total cost per unit for each product line if the direct labor and direct materials costs per unit are $310 for Model 145 and $180 for Model 212.3. If the market price for Model 145 is $1,400 and the market price for Model 212 is $320, determine the profit or loss per unit for each model.arrow_forwardRamsey Company produces speakers (Model A and Model B). Both products pass through two producing departments. Model A's production is much more labor-intensive than that of Model B. Model B is also the more popular of the two speakers. The following data has been gathered for the two products: Units produced per year Prime costs Direct labor hours Machine hours Production runs Inspection hours Maintenance hours Overhead costs: Setup costs Inspection costs Machining Maintenance Total Model A 10,000 $153,000 144,000 17,000 30 900 9,000 $216,000 220,000 172,000 300,000 $908,000 Product Data Model B 100,000 $1,530,000 310,000 204,000 60 1,300 91,000arrow_forwardPlease help finding solution for this problem Required : (1) Predertmined overhead rate cutting and finishing department REquired : (2)Total Mafacturing cost White Company has two departments, Cutting and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department bases its rate on direct labor-hours. At the beginning of the year, the company made the following estimates: Department Cutting Finishing Direct labor-hours 8,800 62,000 Machine-hours 65,700 1,500 Total fixed manufacturing overhead cost $ 380,000 $ 489,000 Variable manufacturing overhead per machine-hour $ 2.00 — Variable manufacturing overhead per direct labor-hour — $ 4.75 Department Cutting Finishing Direct labor-hours 4 12 Machine-hours 90 4 Direct materials $ 720 $ 360 Direct labor…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning