Concept explainers

(Appendix 4A) Predetermined

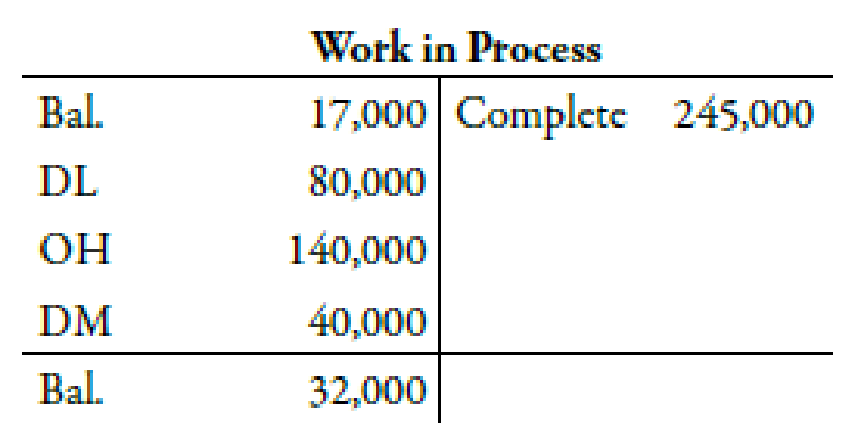

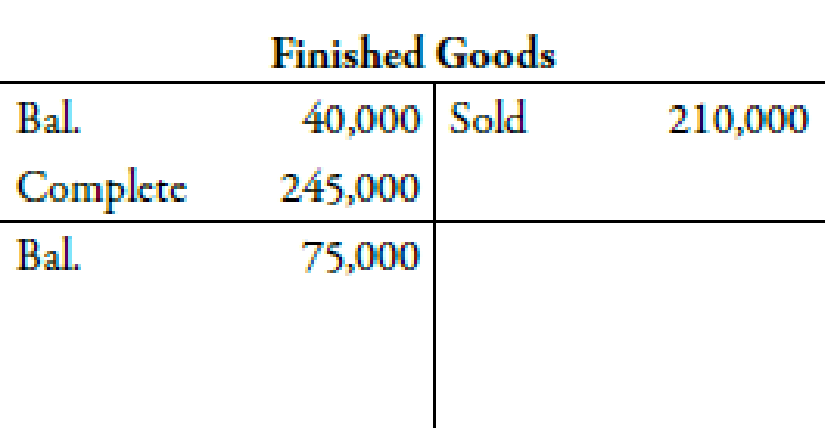

Barrymore Costume Company, located in New York City, sews costumes for plays and musicals. Barrymore considers itself primarily a service firm, as it never produces costumes without a preexisting order and only purchases materials to the specifications of the particular job. Any finished goods ending inventory is temporary and is zeroed out as soon as the show producer pays for the order. Overhead is applied on the basis of direct labor cost. During the first quarter of the year, the following activity took place in each of the accounts listed:

Job 32 was the only job in process at the end of the first quarter. A total of 1,000 direct labor hours at $10 per hour were charged to Job 32.

Required:

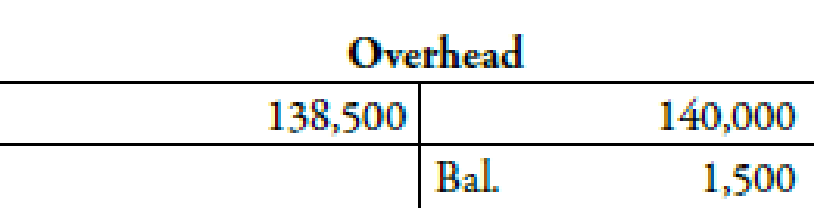

- 1. Assuming that overhead is applied on the basis of direct labor cost, what was the overhead rate used during the first quarter of the year?

- 2. What was the applied overhead for the first quarter? The actual overhead? The under- or overapplied overhead?

- 3. What was the cost of goods manufactured for the quarter?

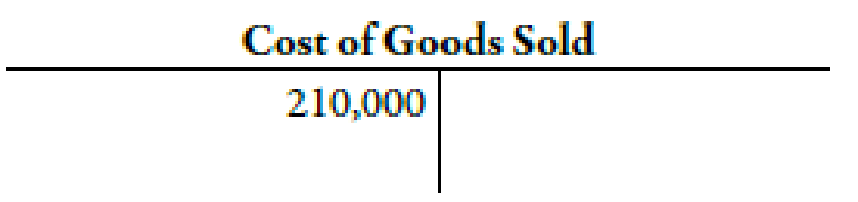

- 4. Assume that the overhead variance is closed to the cost of goods sold account. Prepare the

journal entry to close out the overhead control account. What is the adjusted balance in Cost of Goods Sold? - 5. For Job 32, identify the costs incurred for direct materials, direct labor, and overhead.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- The cost accountant of L. Rosales, Inc. is considering to use the ABC system in determining the cost of its products. At present, the company uses the traditional costing systems wherein factory overhead costs are allocated based on direct labor hours. This cost accountant believes that the present system may be providing misleading cost information, hence, the plan to change to ABC system. For the coming period, the company is planning to use 5,000 direct labor hours, and its total budgeted factory overhead amounts to P 90,000, broken down as follows: Activity Cost Driver Budgeted Activity Budgeted Cost Sets up cost Number of set ups 40 P 20,000 Production monitoring Number of batches 20 40,000 Quality control Number of inspections 1,000 30,000 Total overhead…arrow_forwardRemnant Carpet Company sells and installs commercial carpeting for office buildings. Remnant Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On October 1, Remnant Carpet Company gave Jackson Consulting an estimate of $2,716 to carpet the consulting firm’s newly leased office. The estimate was based on the following data: Estimated direct materials: 30 meters at $32 per meter $ 960 Estimated direct labor: 28 hours at $20 per hour 560 Estimated factory overhead (75% of…arrow_forwardRemnant Carpet Company sells and installs commercial carpeting for office buildings. Remnant Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On October 1, Remnant Carpet Company gave Jackson Consulting an estimate of $2,716 to carpet the consulting firm’s newly leased office. The estimate was based on the following data: Estimated direct materials: 30 meters at $32 per meter $ 960 Estimated direct labor: 28 hours at $20 per hour 560 Estimated factory overhead (75% of…arrow_forward

- H12 18 hours at $19 342 Required: Enter amounts as positive numbers. Round answers to the nearest whole dollar. 1. Complete that portion of the job order cost sheet that would be prepared when the estimate is given to the customer. 2. Record the costs incurred, and complete the job order cost sheet. JOB ORDER COST SHEET Customer Lunden Consulting Date May 9 Date wanted May 15 Date completed May 15 Job. No. ESTIMΑΤΕ Direct Materials Direct Labor Summary Amount Amount Amount 400 meters at $32 30 hours at $20 Direct Materials Direct Labor Factory Overhead Total Total Total cost ACTUALarrow_forwardStretch and Trim Carpet Company sells and installs commercial carpeting for office buildings. Stretch and Trim Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available for management to use in evaluating the efficiency of operations and in preparing quotes on future jobs. On May 9, Stretch and Trim gave Lunden Consulting an estimate of $18,044 to carpet the consulting firm’s newly leased office. The estimate was based on the following data: See attachmentInstructions1. Complete that portion of the job order cost sheet that would be prepared when the estimate is given to the customer. Round…arrow_forwardMethod of Least Squares, Predicting Cost for Different Time Periods from the One Used to Develop a Cost Formula Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controller's department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows: Month Receiving Orders Receiving Cost 1 1,000 $18,000 2 700 $15,000 3 1,500 $28,000 4 1,200 $17,000 5 1,300 $25,000 6 1,100 $21,000 7 1,600 $29,000 8 1,400 $24,000 9 1,700 $27,000 10 900 $16,000 Assume that Tracy…arrow_forward

- A stapler manufacturer uses a single plantwide predetermined overhead allocation rate to allocate its indirect costs. The CFO thinks this process could be inaccurate. Which of the following statement is incorrect, if the manufacture makes the transition to using multiple predetermined overhead allocation rates? A. The allocation process changes because there are now multiple cost pools and multiple allocation bases. B. Management must analyze the expected overhead costs and separate them into a cost pool for each department. C. In selecting machine usage as the primary cost driver for the Production Department, management feels that there is a direct relationship between the number of machine hours used and the amount of overhead costs incurred. D. The use of multiple predetermined overhead allocation rates is more complex, but it may be more accurate.arrow_forwardScattergraph, High–Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controller's department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows: Month Receiving Orders Receiving Cost ($) 1 1,000 27,000 2 700 22,500 3 1,500 42,000 4 1,200 25,500 5 1,300 37,500 6 1,100 31,500 7 1,600 43,500 8 1,400 36,000 9 1,700 40,500 10 900 24,000 Required: 1. On your own paper, prepare a scattergraph based on the 10…arrow_forwardHow can I get this problem resolve? High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company uses a job-order costing system in which departmental predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Molding Department is based on machine-hours, and the rate in the Painting Department is based on direct labor-hours. At the beginning of the year, the company provided the following estimates: Department Molding Painting Direct labor-hours 36,500 59,800 Machine-hours 87,000 34,000 Fixed manufacturing overhead cost $ 208,800 $ 532,220 Variable manufacturing overhead per machine-hour $ 3.20 - Variable manufacturing overhead per direct labor-hour - $ 5.20 Job 205 was started on August 1 and completed on August 10. The company's cost records show the following information concerning the job: Department…arrow_forward

- Unilever Ghana Ltd (UGL) makes three main product lines of soap in batches. The management of UGL is reviewing the cost accounting policy concerning overheads. Currently, the company absorbs overheads based on direct labour hours. Some management board members feel that the company should switch to activity-based costing (ABC) since the product lines demand its overhead resources differently. You have been asked to demonstrate the difference between the existing and the proposed methos of dealing with overheads. The following information is available to assist you: Materials (ghc12 per kilo) Labour (ghc9 per hour) Machine hours per unit Units per batch Sales price Sales demand (units) Overhead Cost Machine related Quality testing. Machine set up costs Material movements Geisha 36 9 6 minutes. 40 63 3,200 74,500 16,950 54,350 60,000 Sunlight 18 18 12 minutes 60 58 3,600 Driven by machine hours Driven by number of units Driven by number of atch Driven by number of kilos Lifebouy 24 13.5…arrow_forwardUnilever Ghana Ltd (UGL) makes three main product lines of soap in batches. The management of UGL is reviewing the cost accounting policy concerning overheads. Currently, the company absorbs overheads based on direct labour hours. Some management board members feel that the company should switch to activity-based costing (ABC) since the product lines demand its overhead resources differently. You have been asked to demonstrate the difference between the existing and the proposed methos of dealing with overheads. The following information is available to assist you: Sunlight Materials (ghc12 per kilo) Labour (ghc9 per hour) Machine hours per unit Units per batch Sales price Sales demand (units) Overhead Cost Machine related Quality testing Geisha Material movements 36 9 6 minutes 40 63 3,200 74,500 16,950 Machine set 54,350 up costs 60,000 18 18 12 minutes 60 58 3,600 Driven by machine hours Driven by number of units Driven by number of batches Driven by number of kilos Lifebouy 24 13.5…arrow_forwardUnilever Ghana Ltd (UGL) makes three main product lines of soap in batches. The management of UGL is reviewing the cost accounting policy concerning overheads. Currently, the company absorbs overheads based on direct labour hours. Some management board members feel that the company should switch to activity-based costing (ABC) since the product lines demand its overhead resources differently. You have been asked to demonstrate the difference between the existing and the proposed methos of dealing with overheads. The following information is available to assist you: Materials (ghc12 per kilo) Labour (ghc9 per hour) Machine hours per unit Units per batch Sales price Sales demand (units) Overhead Cost Machine related Quality testing Machine set up costs Material movements Geisha 36 9 6 minutes. 40 63 3,200 74,500 16,950 54,350 60,000 Sunlight 18 18 12 minutes 60 58 3,600 Driven by machine hours Driven by number of units Driven by number of batches Driven by number of kilos Lifebouy 24…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning