Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 12E

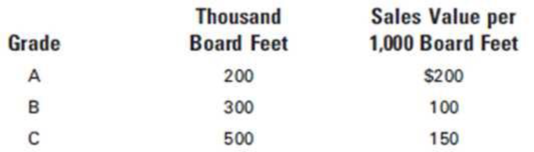

Adirondack Bat Co. processes rough timber to obtain three grades of lumber, A, B, and C that are then made into baseball bats. The company allocates joint costs to the joint products on the basis of the sales value at the split-off point. During the month of May, Adirondack incurred total joint production costs of $300,000 in producing the following:

- 1. Make the

journal entry to transfer the finished lumber to separate work in process inventory accounts for each product. - 2. What would be the allocation of the joint costs if the company were to use the physical measure method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) emerge from the process. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October:

Trees processed:

320 trees

Production:

paper 180,000 sheets

pencil casings 180,000

Sales:

paper 169,000 at $0.10 per page

pencil casings 177,500 at $0.13 per casing

The cost of purchasing 320 trees and processing them up to the split-off point to yield 180,000 sheets of paper and 180,000 pencil casings is $13,000.

Bismite's accounting department reported no beginning inventory.

What are the paper's and the pencil's approximate weighted cost proportions using the sales value at split-off method, respectively?

Beverage Drink Company processes direct

materials up to the splitoff point where two

products, A and B, are obtained. The

following information was collected for the

month of July: Production: A 1500 liters, B

500 liters. The joint cost was $10000.

There were no inventory balances of A and

B. Product A may be processed further to

yield 1500 liters of Product Z5 for an

additional processing cost of $2 per liter.

Product Z5 is sold for $20 per liter. There

was no beginning inventory and ending

inventory was 150 liters. Product B may be

processed further to yield 500 liters of

Product W3 for an additional processing

cost of $4. Product W3 is sold for $30 per

liter. There was no beginning inventory and

ending inventory was 50 liters. --using

constant gross-margin percentage NRV

method, gross margin of X:

Select one:

a. $6500

b. $14600

c. $5400

O d. $18900

+

3

...

Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October:

Trees processed: 250 trees

Production: paper 180,000 sheets

pencil casings 180,000

Sales: paper 174,000 at $0.12 per page

pencil casings 178,500 at $0.15 per casing

The cost of purchasing 250 trees and processing them up to the split-off point to yield 180,000 sheets of paper and 180,000 pencil casings is $12,500.

Bismite's accounting department reported no beginning inventory.

What are the paper's and the pencil's approximate weighted cost…

Chapter 6 Solutions

Principles of Cost Accounting

Ch. 6 - Under what conditions may the unit costs of...Ch. 6 - When is it necessary to use separate equivalent...Ch. 6 - Why is it usually reasonable to assume that labor...Ch. 6 - If materials are not put into process uniformly,...Ch. 6 - In what way do the cost of production summaries in...Ch. 6 - Why might the total number of units completed...Ch. 6 - What is the usual method of handling the cost of...Ch. 6 - If some units are normally lost during the...Ch. 6 - How is the cost of units normally lost reflected...Ch. 6 - Prob. 10Q

Ch. 6 - What adjustment must be made if materials added in...Ch. 6 - What is the difference between the unit costs are...Ch. 6 - What advantage does the FIFO cost method have over...Ch. 6 - How would you define each of the following? a....Ch. 6 - What are three methods of allocating joint costs?

Ch. 6 - Prob. 16QCh. 6 - Prob. 17QCh. 6 - Using the data given for Cases 13 below, and...Ch. 6 - Precision Inc. manufactures wristwatches on an...Ch. 6 - The following data appeared in the accounting...Ch. 6 - Conte Chemical Co. uses the weighted average cost...Ch. 6 - Assuming that all materials are added at the...Ch. 6 - Foamy Inc. manufactures shaving cream and uses the...Ch. 6 - Calculating unit costs; units lost in production...Ch. 6 - Sonoma Products Inc. manufactures a liquid product...Ch. 6 - A company manufactures a liquid product called...Ch. 6 - Using the data given for Cases 1–3 and the FIFO...Ch. 6 - Assume each of the following conditions concerning...Ch. 6 - Adirondack Bat Co. processes rough timber to...Ch. 6 - Computing joint costssales value at split-off and...Ch. 6 - LeMoyne Manufacturing Inc.’s joint cost of...Ch. 6 - Making a journal entryby-product Petrone Metals...Ch. 6 - Espana Co. makes one main product, Uno, and a...Ch. 6 - Manufacturing data for January and February in the...Ch. 6 - Manufacturing data for June and July in the...Ch. 6 - On December 1, Carmel Valley Production Inc. had a...Ch. 6 - Akron Manufacturing Co. manufactures a...Ch. 6 - Green Products Inc. cans peas and uses the...Ch. 6 - Monterrey Products Co. uses the process cost...Ch. 6 - Prob. 7PCh. 6 - Daytona Beverages Inc. uses the FIFO cost method...Ch. 6 - Clearwater Candy Co. had a cost per equivalent...Ch. 6 - Mt. Palomar Manufacturing Co. uses a process cost...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Venezuela Oil Inc. transports crude oil to its...Ch. 6 - Clark Kent Inc. buys crypton for $.80 a gallon. At...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring 250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows: An assistant in the companys cost accounting department was overheard saying ...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort. Which of the following strategies should be recommended for Oakes?arrow_forwardDuring October, McCourt Associates incurred total production costs of 60,000 for copyediting manuscripts and had the following equivalent units schedule: Required: 1. Calculate the cost of copyediting one manuscript for October. 2. Assign costs to manuscripts completed and to EWIP and then do a cost reconciliation. 3. What if the costs assigned to units completed and EWIP total were calculated using a unit cost of 225? What is the discrepancy between the costs assigned and the costs to account for? What could have caused an incorrect unit cost?arrow_forwardIn Department C of Samantha Corporation, a portion of the materials (a by-product) is removed further processed and sold. The entity uses the reversal costmethod to account for the by-product. Data for June include: Amount of by-productremoved is 2,000 units; Estimated sales price of by-product after processing further is$1.20/unit. Estimated processing cost after separation is $0.30 per unit andestimated selling expenses is 10% of the sales price. The estimated profit margin is5% of the sales price. a. How much is the total cost of the by-product?b. How much is the gain (loss) on sale of the by-product if all of the units are sold at $1.50?arrow_forward

- Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) emerge from the process. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October: Trees processed: 300 trees Production: paper 200,000 sheets pencil casings 200,000 Sales: paper 195,000 at $0.10 per page pencil casings 195,500 at $0.16 per casing The cost of purchasing 300 trees and processing them up to the split-off point to yield 200,000 sheets of paper and 200,000 pencil casings is $12,500. Bismite's accounting department reported no beginning inventory. What is the total sales value at the split-off point of the pencil casings?arrow_forwardChem Manufacturing Company processes direct materials up to the splitoff point where two products (X and Y) are obtained and sold. The following information was collected for the month of November: Production: X 3000 gallons, Y 2000 gallons . Sales: X 2600 at $15 per gallon ,Y 1700 at $10 per gallon. The joint cost was $20000. No beginning inventories of X and Y. --- Using the physical-volume method, joint cost allocated for X : Select one: O a. $20000 O b. $8000 c. $12000 O d. $10000arrow_forwardCorp purchases trees from Vendor and processes them up to the splitoff point where two products (paper and pencil casings) are obtained and sold separately. The following information was collected for the month of October: Trees processed: 250 trees Production: paper pencil casings Sales: paper pencil casings 180,000 sheets 180,000 174,000 at $0.12 per page 178,500 at $0.15 per casing The cost of purchasing 250 trees and processing them up to the splitoff point to yield 180,000 sheets of paper and 180,000 pencil casings is $12,500. Corp's accounting department reported no beginning inventory.arrow_forward

- Corp purchases trees from Vendor and processes them up to the splitoff point where two products (paper and pencil casings) are obtained and sold separately. The following information was collected for the month of October: Trees processed: 250 trees Production: paper pencil casings Sales: paper pencil casings 180,000 sheets 180,000 174,000 at $0.12 per page 178,500 at $0.15 per casing The cost of purchasing 250 trees and processing them up to the splitoff point to yield 180,000 sheets of paper and 180,000 pencil casings is $12,500. Corp's accounting department reported no beginning inventory. 1) What is the total sales value at the splitoff point for paper? 2) What is the total sales value at the splitoff point of the pencil casings? 3) What are the paper's and the pencil's approximate weighted cost proportions using the sales value at splitoff method, respectively? 4) If the sales value at splitoff method is used, what are the approximate joint costs assigned to ending inventory for…arrow_forwardBismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) are obtained. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October: Trees processed: 280 trees Production: paper 160,000 sheets pencil casings 160,000 Sales: paper 147,000 at $0.10 per page pencil casings 158,500 at $0.13 per casing The cost of purchasing 280 trees and processing them up to the split-off point to yield 160,000 sheets of paper and 160,000 pencil casings is $13,000. Bismite's accounting department reported no beginning inventory. What is the total sales value at the split-off point for paper?arrow_forwardLilitop Corporation purchases trees from Hummer lumber and processes them up to the split-off point where two products (paper and pencil casings) emerge from the process. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October: Trees processed: 270 trees Production: раper 150,000 sheets pencil casings 150,000 Sales: paper 137,000 at $0.10 per page pencil casings 149.000 at $0.14 per casing The cost of purchasing 270 trees and processing them up to the split-off point to yield 150,000 sheets of paper and 150,000 pencil casings is $14,500. Lilitop's accounting department reported no beginning inventory. What is the total sales value at the split-off point of the pencil casings? O $13,700 O $15.000 O $20,860 O $21,000arrow_forward

- Douglass Minerals mines ore and then processes it into other products. At the end of the mining process, the ore splits off into three products: Metal-A, Metal-B, and Metal-C. Douglass sells Metal-C at the split-off point, with no further processing. Metal-A is processed in Plant A, and Metal-B is processed in Plant B. The following is a summary of costs and other related data for the period ended December 31: Process: Labor Manufacturing overhead Products Units sold Units in ending inventory (December 31) Sales revenue Mining $ 476,000 $ 392,000 Required: Compute the following: Plant A $ 418,000 $ 347,200 Plant B $ 284,000 $ 140,000 a. Net realizable value of Metal-C b. Joint costs c. Cost of Metal-B sold d. Ending inventory for Metal-C Metal-B 200,000 Metal-A 230,000 79,000 $ 1,150,000 $ 590,000 a. The net realizable value of Metal-C for the period ended December 31. b. The joint costs for the period ended December 31 to be allocated. c. The cost of Metal-B sold for the period ended…arrow_forwardDouglass Minerals mines ore and then processes it into other products. At the end of the mining process, the ore splits off into three products: Metal-A, Metal-B, and Metal-C. Douglass sells Metal-C at the split-off point, with no further processing. Metal-A is processed in Plant A, and Metal-B is processed in Plant B. The following is a summary of costs and other related data for the period ended December 31: Process: Labor Manufacturing overhead Products Units sold Units in ending inventory (December 31) Sales revenue Mining $ 462,000 $ 378,000 Required: Compute the following: Note: Do not round intermediate calculations. d. The value of the ending inventory for Metal-C. Note: Do not round intermediate calculations. a. Net realizable value of Metal-C b. Joint costs c. Cost of Metal-B sold d. Ending inventory for Metal-C Plant A $ 390,000 $ 327,600 $ $ Plant B $ 270,000 $ 126,000 Douglass Minerals had no beginning inventories on hand at the beginning of the period. Douglass Minerals…arrow_forwardDouglass Minerals mines ore and then processes it into other products. At the end of the mining process, the ore splits off into three products: Metal-A, Metal-B, and Metal-C. Douglass sells Metal-C at the split-off point, with no further processing. Metal-A is processed in Plant A, and Metal-B is processed in Plant B. The following is a summary of costs and other related data for the period ended December 31: Process: Labor Manufacturing overhead Products Units sold Units in ending inventory (December 31) Sales revenue Mining $ 475,000 $ 391,000 Required: Compute the following: Plant A $ 416,000 $ 345,800 a. Net realizable value of Metal-C b. Joint costs c. Cost of Metal-B sold d. Ending inventory for Metal-C Metal-A Plant B $ 283,000 $ 139,000 229,000 78,500 $ 1,145,000 Metal-B 196,000 0 $ 589,000 Metal-C Douglass Minerals had no beginning inventories on hand at the beginning of the period. Douglass Minerals uses the net realizable value method to allocate joint costs. 78,500 74,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License