Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 5P

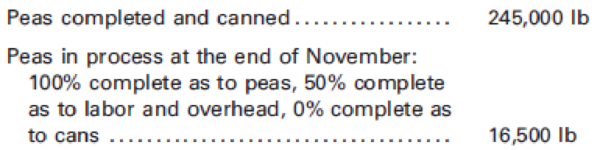

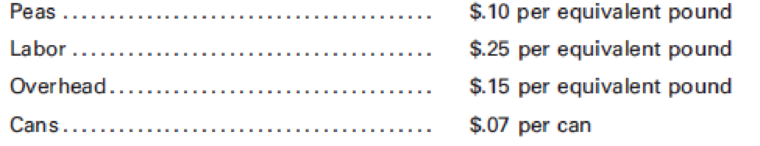

Green Products Inc. cans peas and uses the weighted average cost method. For the month of November, the company showed the following:

Cost data:

Each can contains 16 oz, or 1 lb, of peas.

Required:

- 1. Calculate the cost of the completed production for November.

- 2. Show the detailed cost of the ending inventory for November.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Mark's Meals produces frozen meals, which it sells for $9 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months in business:

(Click the icon to view the data.)

Read the requirements.

Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February.

February

Less:

Less

January

Less:

Absorption

costing

Total product cost

Requirement 2a. Prepare separate monthly income statements for January and for February, using absorption costing.

Mark's Meals

Income Statement (Absorption Costing)

Month Ended

Less:

Variable

costing

Absorption

costing

Variable

costing

Requirement 2b. Prepare Mark's Meals' January and February income statements using variable costing.

Mark's…

A manufacturing company produces a product that requires two types of materials: material A and material B. The company uses the weighted-average method to calculate material costs. The following information is available for the month of February: Beginning inventory: • Material A: 200 units at Shs.5 per unit • Material B: 300 units at Shs.8 per unit Purchases during the month: • Material A: 1,000 units at Shs.6 per unit • Material B: 800 units at Shs.10 per unit Ending inventory: • Material A: 400 units • Material B: 500 units During the month, 1,200 units of the product were produced, and the total material cost was Shs.17,760. Required: What is the cost per unit for material A and material B? Show all workings.

Mario’s Foods produces frozen meals, which it sells for $8 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company’s first two months in business: (picture chart 1)

Compute the product cost per meal produced under absorption costing and under variable costing. Do this first for January and then for February.

Prepare separate monthly income statements for January and for February, using the following: a. Absorption costing b. Variable costing

Is operating income higher under absorption costing or variable costing in January? In February? Explain the pattern of differences in operating income based on absorption costing versus variable costing.

Chapter 6 Solutions

Principles of Cost Accounting

Ch. 6 - Under what conditions may the unit costs of...Ch. 6 - When is it necessary to use separate equivalent...Ch. 6 - Why is it usually reasonable to assume that labor...Ch. 6 - If materials are not put into process uniformly,...Ch. 6 - In what way do the cost of production summaries in...Ch. 6 - Why might the total number of units completed...Ch. 6 - What is the usual method of handling the cost of...Ch. 6 - If some units are normally lost during the...Ch. 6 - How is the cost of units normally lost reflected...Ch. 6 - Prob. 10Q

Ch. 6 - What adjustment must be made if materials added in...Ch. 6 - What is the difference between the unit costs are...Ch. 6 - What advantage does the FIFO cost method have over...Ch. 6 - How would you define each of the following? a....Ch. 6 - What are three methods of allocating joint costs?

Ch. 6 - Prob. 16QCh. 6 - Prob. 17QCh. 6 - Using the data given for Cases 13 below, and...Ch. 6 - Precision Inc. manufactures wristwatches on an...Ch. 6 - The following data appeared in the accounting...Ch. 6 - Conte Chemical Co. uses the weighted average cost...Ch. 6 - Assuming that all materials are added at the...Ch. 6 - Foamy Inc. manufactures shaving cream and uses the...Ch. 6 - Calculating unit costs; units lost in production...Ch. 6 - Sonoma Products Inc. manufactures a liquid product...Ch. 6 - A company manufactures a liquid product called...Ch. 6 - Using the data given for Cases 1–3 and the FIFO...Ch. 6 - Assume each of the following conditions concerning...Ch. 6 - Adirondack Bat Co. processes rough timber to...Ch. 6 - Computing joint costssales value at split-off and...Ch. 6 - LeMoyne Manufacturing Inc.’s joint cost of...Ch. 6 - Making a journal entryby-product Petrone Metals...Ch. 6 - Espana Co. makes one main product, Uno, and a...Ch. 6 - Manufacturing data for January and February in the...Ch. 6 - Manufacturing data for June and July in the...Ch. 6 - On December 1, Carmel Valley Production Inc. had a...Ch. 6 - Akron Manufacturing Co. manufactures a...Ch. 6 - Green Products Inc. cans peas and uses the...Ch. 6 - Monterrey Products Co. uses the process cost...Ch. 6 - Prob. 7PCh. 6 - Daytona Beverages Inc. uses the FIFO cost method...Ch. 6 - Clearwater Candy Co. had a cost per equivalent...Ch. 6 - Mt. Palomar Manufacturing Co. uses a process cost...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Otto Inc. specializes in chicken farming. Chickens...Ch. 6 - Venezuela Oil Inc. transports crude oil to its...Ch. 6 - Clark Kent Inc. buys crypton for $.80 a gallon. At...

Additional Business Textbook Solutions

Find more solutions based on key concepts

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

1. For Frank’s Funky Sounds, straight-line depreciation on the trucks is a

Learning Objective 1

a. variable cos...

Horngren's Accounting (12th Edition)

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

Intermediate Accounting

Adjusting Journal Entries; Adjusted Trial Balance. Magic Cleaning Services (MCS) has a fiscal year-end of Decem...

Intermediate Accounting (2nd Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Click the Chart sheet tab. On the screen is a column chart showing ending inventory costs. During a deflationary period, which bar (A, B, or C) represents FIFO costing, which represents LIFO costing, and which represents weighted average? Explain your reasoning. On January 4 following year-end, Rio Enterprises received a shipment of 60 units of product costing 580 each. These units had been ordered by Del in December and had been shipped to him on December 27. They were shipped FOB shipping point. Revise the FIFOLIFO3 worksheet to include this shipment. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as FIFOLIFOT. Using the FIFOLIFO3 file, prepare a 3-D bar (stacked) chart showing the cost of goods sold and ending inventory under each of the four inventory cost flow assumptions. No Chart Data Table is needed. Use the values in the Calculations Section of the worksheet for your chart. Enter your name somewhere on the chart. Save the file again as FIFOLIFO3. Print the chart.arrow_forwardChassen Company, a cracker and cookie manufacturer, has the following unit costs for the month of June: A total of 100,000 units were manufactured during June, of which 10,000 remain in ending inventory. Chassen uses the first-in, first-out (FIFO) inventory method, and the 10,000 units are the only finished goods inventory at June 30. Under the absorption costing concept, the value of Chassens June 30 finished goods inventory would be: a. 50,000. b. 70,000. c. 85,000. d. 145,000.arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forward

- Louie's Meals produces frozen meals, which it sells for $7 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from the company's first two months inbusiness: January February Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Jan 1,600 meals Feb 1,900 meals Production. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Jan 2,000 meals Feb 1,600 meals Variable manufacturing expense per meal. . . . . . . . . . Jan $4 Feb $4 Sales commission expense per meal. . . . . . . . . . . . . . Jan $1 Feb $1 Total fixed manufacturing overhead. . . . . . . . . . . . . Jan $800 Feb $800 Total fixed marketing and administrative expenses. . Jan $300 Feb $300 Requirement 1. Compute the product cost per meal…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the productionof semi-trailer trucks. The wiring harness assemblies are sold to various truckmanufacturers around the world. Projected sales in units for the coming fivemonths are given below. January 10.000 February 10.500 March 13.000 April 16.000 May 18.500 The following data pertain to production policies and manufacturingspecifications followed by Ponderosa:a. Finished goods inventory on January 1 is 900 units. The desired endinginventory for each month is 20 percent of the next month's sales.b. The data on materials used are as follows: Direct material Per unit usage Unit cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at thebeginning of the month to satisfy 30 percent of the next month'sproduction needs. This is exactly the amount of material…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the productionof semi-trailer trucks. The wiring harness assemblies are sold to various truckmanufacturers around the world. Projected sales in units for the coming fivemonths are given below. January 10.000 February 10.500 March 13.000 April 16.000 May 18.500 The following data pertain to production policies and manufacturingspecifications followed by Ponderosa:a. Finished goods inventory on January 1 is 900 units. The desired endinginventory for each month is 20 percent of the next month's sales.b. The data on materials used are as follows: Direct material Per unit usage Unit cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at thebeginning of the month to satisfy 30 percent of the next month'sproduction needs. This is exactly the amount of material…arrow_forward

- Ponderosa, Inc., produces wiring harness assemblies used in the productionof semi-trailer trucks. The wiring harness assemblies are sold to various truckmanufacturers around the world. Projected sales in units for the coming fivemonths are given below. January 10.000 February 10.500 March 13.000 April 16.000 May 18.500 The following data pertain to production policies and manufacturingspecifications followed by Ponderosa:a. Finished goods inventory on January 1 is 900 units. The desired endinginventory for each month is 20 percent of the next month's sales.b. The data on materials used are as follows: Direct material Per unit usage Unit cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at thebeginning of the month to satisfy 30 percent of the next month'sproduction needs. This is exactly the amount of material…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the productionof semi-trailer trucks. The wiring harness assemblies are sold to various truckmanufacturers around the world. Projected sales in units for the coming fivemonths are given below. January 10.000 February 10.500 March 13.000 April 16.000 May 18.500 The following data pertain to production policies and manufacturingspecifications followed by Ponderosa:a. Finished goods inventory on January 1 is 900 units. The desired endinginventory for each month is 20 percent of the next month's sales.b. The data on materials used are as follows: Direct material Per unit usage Unit cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at thebeginning of the month to satisfy 30 percent of the next month'sproduction needs. This is exactly the amount of material…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below. January 10,000 February 10,500 March 13,900 April 16,000 May 18,500 The following data pertain to production policies and manufacturing specifications followed by Ponderosa: Finished goods inventory on January 1 is 900 units. The desired ending inventory for each month is 20 percent of the next month’s sales. The data on materials used are as follows: Direct Material Per-Unit Usage Unit Cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 30 percent of the next month’s production needs. This is exactly the amount of material on hand on January 1. The direct labor used per unit of…arrow_forward

- Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below. January 10,000 February 10,500 March 13,900 April 16,000 May 18,500 The following data pertain to production policies and manufacturing specifications followed by Ponderosa: Finished goods inventory on January 1 is 900 units. The desired ending inventory for each month is 20 percent of the next month’s sales. The data on materials used are as follows: Direct Material Per-Unit Usage Unit Cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 30 percent of the next month’s production needs. This is exactly the amount of material on hand on January 1. The direct labor used per unit of…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below. January 10,000 February 10,500 March 13,900 April 16,000 May 18,500 The following data pertain to production policies and manufacturing specifications followed by Ponderosa: Finished goods inventory on January 1 is 900 units. The desired ending inventory for each month is 20 percent of the next month’s sales. The data on materials used are as follows: Direct Material Per-Unit Usage Unit Cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 30 percent of the next month’s production needs. This is exactly the amount of material on hand on January 1. The direct labor used per unit of…arrow_forwardPonderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks. The wiring harness assemblies are sold to various truck manufacturers around the world. Projected sales in units for the coming five months are given below. January 10,000 February 10,500 March 13,900 April 16,000 May 18,500 The following data pertain to production policies and manufacturing specifications followed by Ponderosa: Finished goods inventory on January 1 is 900 units. The desired ending inventory for each month is 20 percent of the next month’s sales. The data on materials used are as follows: Direct Material Per-Unit Usage Unit Cost Part #K298 2 $4 Part #C30 3 7 Inventory policy dictates that sufficient materials be on hand at the beginning of the month to satisfy 30 percent of the next month’s production needs. This is exactly the amount of material on hand on January 1. The direct labor used per unit of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

INVENTORY & COST OF GOODS SOLD; Author: Accounting Stuff;https://www.youtube.com/watch?v=OB6RDzqvNbk;License: Standard Youtube License