Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 3CMA

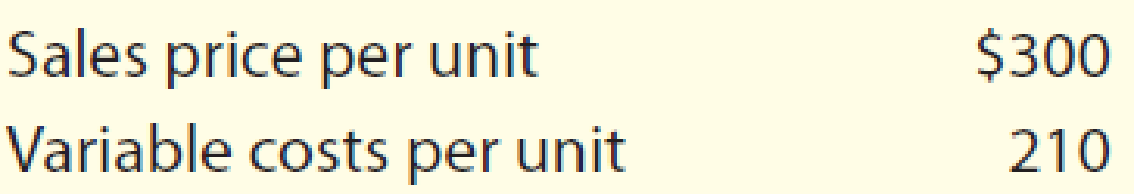

Bolger and Co. manufactures large gaskets for the turbine industry. Bolger’s per-unit sales price and variable costs for the current year are as follows:

Bolger’s total fixed costs aggregate to $360,000. Bolger’s labor agreement is expiring at the end of the year, and management is concerned about the effects of a new labor agreement on its break-even point in units. The controller performed a sensitivity analysis to ascertain the estimated effect of a $10-per-unit direct labor increase and a $10,000 reduction in fixed costs. Based on these data, the break-even point would:

- a. decrease by 1,000 units.

- b. decrease by 125 units.

- c. increase by 375 units.

- d. increase by 500 units.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Gibson Modems has excess production capacity and is considering the possibility of making and selling paging equipment. The following estimates are based on a production and sales volume of 1,800 pagers.Unit-level manufacturing costs are expected to be $28. Sales commissions will be established at $1.80 per unit. The current facility-level costs, including depreciation on manufacturing equipment ($68,000), rent on the manufacturing facility ($58,000), depreciation on the administrative equipment ($14,400), and other fixed administrative expenses ($75,950), will not be affected by the production of the pagers. The chief accountant has decided to allocate the facility-level costs to the existing product (modems) and to the new product (pagers) on the basis of the number of units of product made (i.e., 5,800 modems and 1,800 pagers).Requireda. Determine the per-unit cost of making and selling 1,800 pagers. (Do not round intermediate calculations. Round your answer to 3 decimal places.)

Finch Modems has excess production capacity and is considering the possibility of making and selling paging equipment. The

following estimates are based on a production and sales volume of 1,600 pagers.

Unit-level manufacturing costs are expected to be $26. Sales commissions will be established at $1.60 per unit. The current facility-

level costs, including depreciation on manufacturing equipment ($66,000), rent on the manufacturing facility ($56,000), depreciation

on the administrative equipment ($13,800), and other fixed administrative expenses ($74,950), will not be affected by the production of

the pagers. The chief accountant has decided to allocate the facility-level costs to the existing product (modems) and to the new

product (pagers) on the basis of the number of units of product made (i.e., 5,600 modems and 1,600 pagers).

Required

a. Determine the per-unit cost of making and selling 1,600 pagers. (Do not round intermediate calculations. Round your answer to 3

decimal places.)…

Rooney Company is considering adding a new product. The cost accountant has provided the following data:

Expected variable cost of manufacturing

$

49

per unit

Expected annual fixed manufacturing costs

$

68,000

The administrative vice president has provided the following estimates:

Expected sales commission

$

3

per unit

Expected annual fixed administrative costs

$

52,000

The manager has decided that any new product must at least break even in the first year.

Required

Use the equation method and consider each requirement separately.

If the sales price is set at $67, how many units must Rooney sell to break even?

Rooney estimates that sales will probably be 10,000 units. What sales price per unit will allow the company to break even?

Rooney has decided to advertise the product heavily and has set the sales price at $72. If sales are 7,000 units, how much can the company spend on advertising and still break even?

Chapter 20 Solutions

Financial And Managerial Accounting

Ch. 20 - Describe how total variable costs and unit...Ch. 20 - Which of the following costs would be classified...Ch. 20 - Describe how total fixed costs and unit fixed...Ch. 20 - In applying the high-low method of cost estimation...Ch. 20 - If fixed costs increase, what would be the impact...Ch. 20 - Prob. 6DQCh. 20 - Prob. 7DQCh. 20 - Both Austin Company and Hill Company had the same...Ch. 20 - Prob. 9DQCh. 20 - What does operating leverage measure, and how is...

Ch. 20 - High-low method The manufacturing costs of...Ch. 20 - Contribution margin Waite Company sells 250,000...Ch. 20 - Prob. 3BECh. 20 - Prob. 4BECh. 20 - Sales mix and break-even analysis Conley Company...Ch. 20 - Prob. 6BECh. 20 - Margin of safety Jorgensen Company has sales of...Ch. 20 - Classify Costs Following is a list of various...Ch. 20 - Identify cost graphs The following cost graphs...Ch. 20 - Identify activity bases For a major university,...Ch. 20 - Identify activity bases From the following list of...Ch. 20 - Identify fixed and variable costs Intuit Inc....Ch. 20 - Relevant range and fixed and variable costs Child...Ch. 20 - High-low method Ziegler Inc. has decided to use...Ch. 20 - High-low method for a service company Continental...Ch. 20 - Contribution margin ratio Young Company budgets...Ch. 20 - Contribution margin and contribution margin ratio...Ch. 20 - Break-even sales and sales to realize operating...Ch. 20 - Prob. 12ECh. 20 - Prob. 13ECh. 20 - Prob. 14ECh. 20 - Break-even analysis Media outlets such as ESPN and...Ch. 20 - Prob. 16ECh. 20 - Prob. 17ECh. 20 - Prob. 18ECh. 20 - Prob. 19ECh. 20 - Prob. 20ECh. 20 - Prob. 21ECh. 20 - Break-even sales and sales mix for a service...Ch. 20 - Margin of safety A. If Canace Company, with a...Ch. 20 - Prob. 24ECh. 20 - Operating leverage Beck Inc. and Bryant Inc. have...Ch. 20 - Classify costs Seymour Clothing Co. manufactures a...Ch. 20 - Prob. 2PACh. 20 - Prob. 3PACh. 20 - Prob. 4PACh. 20 - Prob. 5PACh. 20 - Contribution margin, break-even sales,...Ch. 20 - Classify costs Cromwell Furniture Company...Ch. 20 - Break-even sales under present and proposed...Ch. 20 - Prob. 3PBCh. 20 - Prob. 4PBCh. 20 - Prob. 5PBCh. 20 - Contribution margin, break-even sales,...Ch. 20 - Prob. 1MADCh. 20 - Prob. 2MADCh. 20 - Prob. 3MADCh. 20 - Break-even number of guests for a theme park...Ch. 20 - Prob. 1TIFCh. 20 - Communication Sun Airlines is a commercial airline...Ch. 20 - Profitability strategies Somerset Inc. has...Ch. 20 - Prob. 5TIFCh. 20 - Analysis of costs for a shipping department Sales...Ch. 20 - Taylor Corporation is analyzing the cost behavior...Ch. 20 - Kimber Company has the following unit costs for...Ch. 20 - Bolger and Co. manufactures large gaskets for the...Ch. 20 - Eagle Brand Inc. produces two products as follows:...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company is analyzing a make-versus-purchase situation for a component used in several products, and the engineering department has developed these data:Option A: Purchase 10,000 items per year at a fixed price of $8.50 per item. The cost of placing the order is negligible according to the present cost accounting procedure. Option B: Manufacture 10,000 items per year, using available capacity in the factory. Cost estimates are direct materials = $5.00 per item and direct labor = $1.50 per item. Manufacturing overhead is $3.00 per item. Based on these data, should the item be purchased or manufactured?arrow_forward[The following information applies to the questions displayed below.] Burchard Company sold 42,000 units of its only product for $17.40 per unit this year. Manufacturing and selling the product required $314,000 of fixed costs. Its per unit variable costs follow. Direct materials Direct labor Variable overhead costs Variable selling and administrative costs For the next year, management will use a new material, which will reduce direct materials costs to $1.41 per unit and reduce direct labor costs to $2.59 per unit. Sales, total fixed costs, variable overhead costs per unit, and variable selling and administrative costs per unit will not change. Management is also considering raising its selling price to $22.62 per unit, which would decrease unit sales volume to 35,700 units. Required: 1. Compute the contribution margin per unit from (a) using the new material and (b) using the new material and increasing the selling price. (Round your answers to 2 decimal places.) Sales price per…arrow_forward[The following information applies to the questions displayed below.] Burchard Company sold 42,000 units of its only product for $17.40 per unit this year. Manufacturing and selling the product required $314,000 of fixed costs. Its per unit variable costs follow. Direct materials Direct labor Variable overhead costs Variable selling and administrative costs For the next year, management will use a new material, which will reduce direct materials costs to $1.41 per unit and reduce direct labor costs to $2.59 per unit. Sales, total fixed costs, variable overhead costs per unit, and variable selling and administrative costs per unit will not change. Management is also considering raising its selling price to $22.62 per unit, which would decrease unit sales volume to 35,700 units. 2. Prepare a contribution margin income statement for next year with two columns showing the expected results of (a) using the new material and (b) using the new material and increasing the selling price.…arrow_forward

- Magnificent Modems has excess production capacity and is considering the possibility of making and selling security tokens. The following estimates are based on a production and sales volume of 1,000 security tokens. Unit-level manufacturing costs are expected to be $20. Sales commissions will be established at $1 per unit. The current facility-level costs, including depreciation on manufacturing equipment ($60,000), rent on the manufacturing facility ($50,000), depreciation on the administrative equipment ($12,000), and other fixed administrative expenses ($71,950), will not be affected by the production of the security tokens. The chief accountant has decided to allocate the facility-level costs to the existing product (modems) and to the new product (security tokens) on the basis of the number of units of product made (i.e., 5,000 modems and 1,000 security tokens). Required a. Determine the per-unit cost of making and selling 1,000 security tokens. Note: Do not round intermediate…arrow_forward[The following information applies to the questions displayed below.] Astro Company sold 22,500 units of its only product and reported income of $60,000 for the current year. During a planning session for next year's activities, the production manager notes that variable costs can be reduced 45% by installing a machine that automates several operations. To obtain these savings, the company must increase its annual fixed costs by $155,000. Total units sold and the selling price per unit will not change. ASTRO COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales ($55 per unit) Variable costs ($50 per unit) Contribution margin Fixed costs Income 1. Compute the break-even point in dollar sales for next year assuming the machine is installed. (Round your answers to 2 decimal places.) Contribution margin Contribution Margin Ratio Numerator: Contribution margin per unit $ 1 Fixed costs per unit $ 1,237,500 1,125,000 112,500 52,500 $ 60,000 $ Denominator: Selling price…arrow_forwardLittlefield Partners produce a part sold to agricultural equipment suppliers. For the last year (Year 1), the price, costs, and volume of the part were as follows: Unit price Unit variable cost Annual fixed cost Sales volume Managers at Littlefield believe that next year (Year 2), conditions in the industry will result in lower prices, both for the part they sell and the materials they purchase. Their best estimates at this time are that the selling price will decline by 10 percent while the unit variable cost will decline by 5 percent, taking into account the changes in both materials and labor. They believe that fixed costs will remain the same. $ 60 $ 40 Required: a. What was the break-even volume in number of units last year (Year 1)? b. Assume that the managers estimates are correct for Year 2. How many units would have to be sold in Year 2 to earn the same operating profits as earned in Year 1? Required A Required B $ 3,320,000 c. Assume that the managers' estimates on price and…arrow_forward

- Crane Company has decided to introduce a new product. The new product can be manufactured by either a capital-intensive method or a labor-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows. Direct materials Direct labor Variable overhead Fixed manufacturing costs (a) Crane' market research department has recommended an introductory unit sales price of $40.00. The selling expenses are estimated to be $622,000 annually plus $2.00 for each unit sold, regardless of manufacturing method. (b) Capital-Intensive $6.00 per unit $7.00 per unit $4.00 per unit Your answer is correct. $3,200,000 Calculate the estimated break-even point in annual unit sales of the new product if Crane Company uses the: 1. Capital-intensive manufacturing method. 2. Labor-intensive manufacturing method. Break-even point in units eTextbook and Media Labor-Intensive $7.00 per unit $10.00 per unit $5.50 per unit…arrow_forwardIn the last 6 months, demand for one of Appleby Company's products has dropped off considerably, due mainly to it becoming obsolescent as a result of technological change. Knowing that the equipment used in the manufacture of this product may not be easy to sell, Appleby spent $50,000 on consultants to determine whether it could use the equipment to produce a new product under license by another company. The consultant has determined that this product would have variable production costs of $65 per unit and should sell at a price of $90/unit. The licensing royalty is 5% of gross product revenue. Estimated annual demand is 20,000 units per year. Additional annual operating costs related to this product are $30,000/year (excluding depreciation). Depreciation on the equipment is $15,000. Annual depreciation expense is a: O a. Sunk cost O b. Relevant cost O c. Both sunk and Irrelevant cost Od. Irrelevant costarrow_forwardCleanTech manufactures equipment to mitigate the environmental effects of waste. (a) If Product A has fixed expenses of $15,000 per year and each unit of product has a $0.20 variable cost, and Product B has fixed expenses of $5000 per year and a $0.50 variable cost, at what number of units of annual production will A have the same overall cost as B? (b) As a manager at CleanTech what other data would you need to evaluate these two products?arrow_forward

- The Mayflower Transport Company operates a fleet of delivery trucks in the Ottawa area. It has been determined that if a truck is driven 105,000 kilometers over a one year period the average operating cost is $0.114 per kilometer. If a truck is driven only 70,000 kilometers annually, the operating costs increases to $0.134 per kilometer. a) Using the high-low method, estimate the variable and fixed cost elements of the annual cost of truck operation. b) Using the formula Y=a + bX, present the fixed and variable costs. c) If a truck were driven 80,000 kilometers over a one year period, what total cost would your expect to be incurred?arrow_forwardZachary Modems has excess production capacity and is considering the possibility of making and selling paging equipment. The following estimates are based on a production and sales volume of 3,000 pagers. Unit-level manufacturing costs are expected to be $40. Sales commissions will be established at $3.00 per unit. The current facility- level costs, including depreciation on manufacturing equipment ($80,000), rent on the manufacturing facility ($70,000), depreciation on the administrative equipment ($18,000), and other fixed administrative expenses ($81,950), will not be affected by the production of the pagers. The chief accountant has decided to allocate the facility-level costs to the existing product (modems) and to the new product (pagers) on the basis of the number of units of product made (i.e., 7,000 modems and 3,000 pagers). Required a. Determine the per-unit cost of making and selling 3,000 pagers. (Do not round intermediate calculations. Round your answer to 3 decimal…arrow_forwardThe Colin Division of Crane Company sells its product for $30.00 per unit. Variable costs per unit include: manufacturing, $13.80; and selling and administrative, $4.00. Fixed costs are: $322000 manufacturing overhead, and $54000 selling and administrative. There was no beginning inventory. Expected sales for next year are 46000 units. Matthew Young, the manager of the Colin Division, is under pressure to improve the performance of the Division. As part of the planning process, he has to decide whether to produce 46000 units or 54000 units next year. What would the manufacturing cost per unit be under variable costing for each alternative? 46000 units 54000 units $13.80 $13.80 $17.80 $17.80 $19.55 $20.80 $20.80 $19.55arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License