Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 3CMA

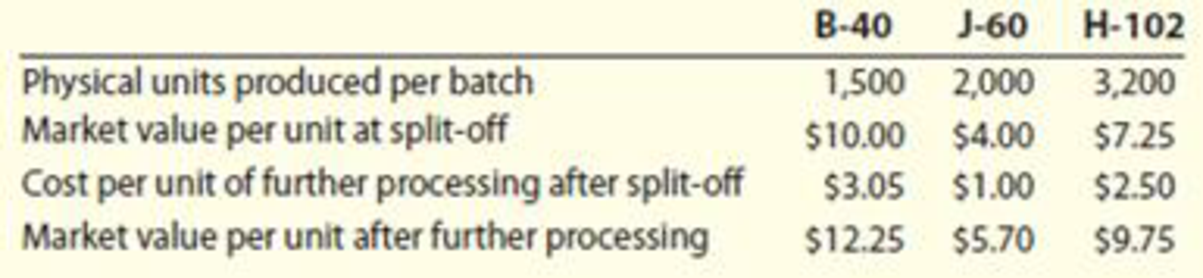

Breegle Company produces three products (B-40, J-60, and H-102) from a single process. Breegle uses the physical volume method to allocate joint costs of $22,500 per batch to the products. Based on the following information, which product(s) should Breegle continue to process after the split-off point in order to maximize profit?

- a. B-40 only

- b. J-60 only

- c. H-102 only

- d. B-40 and H-102 only

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Breegle Company produces three products (B-40, J-60, and H-102) from a single process.Breegle uses the physical volume method to allocate joint costs of $22,500 per batch to theproducts. Based on the following information, which product(s) should Breegle continue toprocess after the split-off point in order to maximize profit?

B-40 J-60 H-102Physical units produced per batch 1,500 2,000 3,200Market value per unit at split-off $10.00 $4.00 $7.25Cost per unit of further processing after split-off $3.05 $1.00 $2.50Market value per unit after further processing $12.25 $5.70 $9.75

a. B-40 onlyb. J-60 only

c. H-102 onlyd. B-40 and H-102 only

Double Company produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows.

DBB-1

DBB-2

DBB-3

Total

Units Sold

16,200

24,300

36,300

76,800

Price (after additional processing)

$ 65

$ 50

$ 75

Separable Processing cost

$ 112,000

$ 46,000

$ 68,000

$ 226,000

Units Produced

16,200

24,300

36,300

76,800

Total Joint Cost

$ 3,610,000

Sales Price at Split-off

$ 25

$ 35

$ 55

The amount of joint costs allocated to product DBB-1 using the physical measure method is:

Multiple Choice

$752,083.

$761,484.

$1,706,289.

$1,203,333.

$1,142,227.

Marin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows.

DBB-1

DBB-2

DBB-3

Total

Units Sold

16,000

24,000

36,000

76,000

Price (after addt’l processing)

$

65

$

50

$

75

Separable Processing cost

$

110,000

$

44,000

$

66,000

$

220,000

Units Produced

16,000

24,000

36,000

76,000

Total Joint Cost

$

3,600,000

Sales Price at Split-off

$

25

$

35

$

55

The amount of joint costs allocated to product DBB-2 using the sales value at split-off method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the…

Chapter 5 Solutions

Managerial Accounting

Ch. 5 - Why are support department costs difficult to...Ch. 5 - Why does support department cost allocation matter...Ch. 5 - What are some drawbacks of applying support...Ch. 5 - Why is the diect method of support department cost...Ch. 5 - How does management determine the order in which...Ch. 5 - Are large or small companies more likely to use...Ch. 5 - What is the main difference between the physical...Ch. 5 - When would management most likely use the net...Ch. 5 - What are the two most often used ways of...Ch. 5 - How can support department and joint cost...

Ch. 5 - Charlies Wood Works produces wood products (e.g.,...Ch. 5 - Bucknum Boys, Inc., produces hunting gear for buck...Ch. 5 - Prob. 3BECh. 5 - Blakes Blacksmith Co. produces two types of...Ch. 5 - Garys Grooves Co. produces two types of carving...Ch. 5 - Prob. 6BECh. 5 - Yo-Down Inc. produces yogurt. Information related...Ch. 5 - Prob. 2ECh. 5 - Blue Africa Inc. produces laptops and desktop...Ch. 5 - Christmas Timber, Inc., produces Christmas trees....Ch. 5 - Crystal Scarves Co. produces winter scarves. The...Ch. 5 - Davis Snowflake Co. produces Christmas stockings...Ch. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - Support department cost allocation comparison...Ch. 5 - Prob. 11ECh. 5 - Prob. 12ECh. 5 - Joint cost allocation market value at split-off...Ch. 5 - Joint cost allocation net realizable value method...Ch. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Joint cost allocation-market value at split-off...Ch. 5 - Joint cost allocation net realizable value method...Ch. 5 - Support department cost allocation Blue Mountain...Ch. 5 - Support activity cost allocation Jakes Gems mines...Ch. 5 - Joint cost allocation Lovely Lotion Inc. produces...Ch. 5 - Joint cost allocation Florissas Flowers jointly...Ch. 5 - Support department cost allocation Hooligan...Ch. 5 - Support activity cost allocation Kizzles Crepes...Ch. 5 - Joint cost allocation McKenzies Soap Sensations,...Ch. 5 - Prob. 4PBCh. 5 - Analyze Milkrageous, Inc. Milkragcous, Inc., a...Ch. 5 - Analyze Horsepower Hookup, Inc. Horsepower Hookup,...Ch. 5 - Prob. 3MADCh. 5 - Prob. 4MADCh. 5 - Joint cost allocation and performance evaluation...Ch. 5 - Prob. 3TIFCh. 5 - Prob. 1CMACh. 5 - Adam Corporation manufactures computer tables and...Ch. 5 - Breegle Company produces three products (B-40,...Ch. 5 - Tucariz Company processes Duo into two joint...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs 12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Required: 1. Allocate the joint cost to L-Ten, Triol, and Pioze using the net realizable value method. (Round the percentages to four significant digits. Round all cost allocations to the nearest dollar.) 2. What if it cost 2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to the three products?arrow_forwardDouble Company produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 16,000 24,000 36,000 76,000 Price (after additional processing) $ 65 $ 50 $ 75 Separable Processing cost $ 110,000 $ 44,000 $ 66,000 $ 220,000 Units Produced 16,000 24,000 36,000 76,000 Total Joint Cost $ 3,600,000 Sales Price at Split-off $ 25 $ 35 $ 55 The amount of joint costs allocated to product DBB-1 using the sales value at split-off method is:arrow_forwardDouble Company produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 20,000 30,000 42,000 92,000 Price (after additional processing) $ 65 $ 50 $ 75 Separable Processing cost $ 150,000 $ 84,000 $ 106,000 $ 340,000 Units Produced 20,000 30,000 42,000 92,000 Total Joint Cost $ 3,800,000 Sales Price at Split-off $ 25 $ 35 $ 55 The amount of joint costs allocated to product DBB-1 using the physical measure method is:arrow_forward

- Marin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 16,000 25,000 36,000 77,000 Price (after addt’l processing) $ 30 $ 15 $ 40 Separable Processing cost $ 179,000 $ 72,000 $ 107,000 $ 358,000 Units Produced 16,000 25,000 36,000 77,000 Total Joint Cost $ 3,600,000 Sales Price at Split-off $ 20 $ 30 $ 50 The amount of joint costs allocated to product DBB-2 using the sales value at split-off method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the…arrow_forwardDouble Company produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 18,200 27,300 39,300 84,800 Price (after additional processing) $ 65 $ 50 $ 75 Separable Processing cost $ 125,125 $ 50,050 $ 72,050 $ 247,225 Units Produced 18,200 27,300 39,300 84,800 Total Joint Cost $ 4,040,000 Sales Price at Split-off $ 25 $ 35 $ 55 The amount of joint costs allocated to product DBB-2 using the sales value at split-off method is: Multiple Choice $1,080,689. $766,632. $514,614. $955,500. $2,444,698.arrow_forwardMarin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 11,000 17,000 24,000 52,000 Price (after addt’l processing) $ 10 $ 25 $ 30 Separable Processing cost $ 282,000 $ 114,000 $ 169,000 $ 565,000 Units Produced 17,600 31,000 39,400 88,000 Total Joint Cost $ 4,800,000 Sales Price at Split-off $ 20 $ 30 $ 50 The amount of joint costs allocated to product DBB-3 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest…arrow_forward

- Double Company produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 18,800 28,200 40,200 87,200 Price (after additional processing) $ 65 $ 50 $ 75 Separable Processing cost $ 129,250 $ 51,700 $ 73,700 $ 254,650 Units Produced 18,800 28,200 40,200 87,200 Total Joint Cost $ 4,160,000 Sales Price at Split-off $ 25 $ 35 $ 55 The amount of joint costs allocated to product DBB-3 using the net realizable value method is:arrow_forwardCARAMEL Inc. manufactures three joint products. The following production data were provided by CARAMEL Inc. for the current period: Product Name Units Produced X Y Z Joint product costs for the current period were as follows: Raw materials Direct labor Factory overhead Costs before separation Costs after separation: X 1,000 2,000 3,000 The company uses the net realizable value method for allocating joint costs. 8. What is the Gross profit/(loss) on the sale of all X products? Y Z Production for April, in pounds: Z Additional Processing Final Selling Price Cost after Split Off 9. What is the total gross profit (loss) on the sale of all the joint products? MACCHIATO Company produces two main products jointly. X and Y. and Z. which is a by- product of Y. X and Y are produced from the same raw material. Z is manufactured from the residue of the process creating Y. Sales for April: Costs before separation are apportioned between the two main products by the net realizable value method. The…arrow_forwardTendler Co. produces two products, X and Y, using a joint process. The following data has been given to you: Joint cost Unit selling prices of completely processed products Units produced and processed beyond split-off Processing cost beyond split-off point Total $3,300 450 $3,700 Allocate the joint cost using the net-realizable value method: X: S XIN Y: S ? $10 300 $1,100 Y ? $40 150 $2,60arrow_forward

- Double Company produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 19,800 29,700 41,700 91,200 Price (after additional processing) $ 65 $ 50 $ 75 Separable Processing cost $ 136,125 $ 54,450 $ 76,450 $ 267,025 Units Produced 19,800 29,700 41,700 91,200 Total Joint Cost $ 4,360,000 Sales Price at Split-off $ 25 $ 35 $ 55 The amount of joint costs allocated to product DBB-3 using the net realizable value method is: Multiple Choice $2,361,764. $1,228,747. $1,107,364. $1,150,875. $890,872.arrow_forwardSunland Inc. produces three separate products from a common process costing $100,100. Each of the products can be sold at the split- off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Product 10 Product 12 Product 14 (c) Product Your answer is partially correct. Product 10 Product 12 Product 14 $ Sales Value at Split-Off Point $59,700 $ 15,800 $ 55,400 Calculate incremental profit/(loss) and determine which products should be sold at the split-off point and which should be processed further. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Incremental profit (loss) Cost to Process Further eTextbook and Media $100,100 30,800 149,700 Sales Value after Further Processing $191,000 34,700 Decision 214,000 Should be processed further Should be sold at the split-off point Should be processed further Assistance Usedarrow_forwardThe Freed Company produces three products, X, Y, Z, from a single raw material input. Product Y can be sold at the split-off point for total revenues of $50,000, or it can be processed further at a total cost of $16,000 and then sold for $68,000. Product Y: А. Should be sold at the split-off point, rather than processed further. В. Would increase the company's overall net operating income by $18,000 if processed further and then sold. С. Would increase the company's overall net operating income by $68,000 if processed further and then sold. D. Would increase the company's overall net operating income by $2,000 if processed further and then sold. Е. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Incremental Analysis - Sell or Process Further; Author: Melissa Shirah;https://www.youtube.com/watch?v=7D6QnBt5KPk;License: Standard Youtube License